Why the "AI-Blinded Market" Might Be Missing the Slow-Motion Economic Crash

Summary

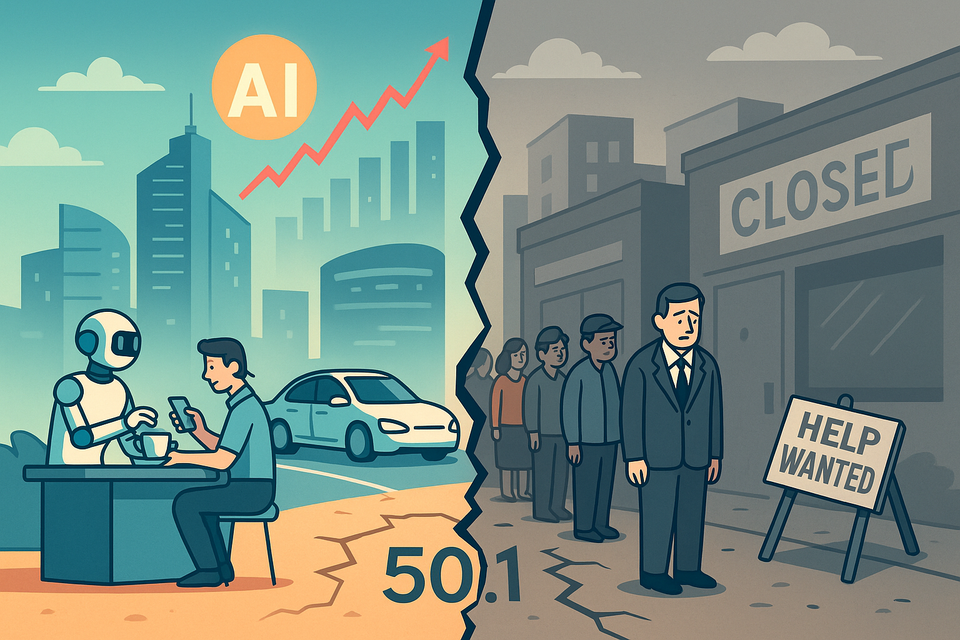

July’s ISM Services PMI came in at 50.1 — dangerously close to contraction territory. Employment fell sharply to 46.4 (lowest since the pandemic), while prices paid surged to a multi-year high. Meanwhile, the stock market is still partying like it’s 1999, thanks to AI hype. So... what if the real economy is quietly slipping into stagflation while everyone’s busy prompt-engineering their portfolios?

Introduction: AI is hot. Services? Not.

Wall Street is head-over-heels for AI. But the real economy? It’s sending breakup texts.

The July 2025 ISM Services PMI dropped to 50.1, well below expectations (consensus was 51.5). Employment? Down to 46.4 — four contractions in five months. Prices paid? Up to 69.9, highest since 2022. That’s not a soft landing. That’s a plane skidding off the runway with Taylor Swift still on the wing.

And yet, the Nasdaq keeps floating upward, carried by Nvidia, Super Micro, and a dozen GPT-powered pipedreams. The disconnect is real — and getting weirder.