Why ‘Made in Mexico’ Is the New ‘Made in China’: Inside the Nearshoring Boom

Summary

As tensions with China persist and supply chain risks remain top-of-mind, U.S. companies are doubling down on Mexico.

Faster delivery, favorable trade terms, and growing industrial capacity have made Mexico a nearshoring hotspot.

Here’s how this shift is unfolding—and what it means for manufacturers and investors.

Introduction: Mexico’s Moment

Not long ago, China was the undisputed center of global manufacturing. But that dominance is starting to erode.

In 2024 and 2025, Mexico has seen a surge in foreign investment and a wave of factory openings, especially in sectors like electric vehicles and semiconductors. From Monterrey to Querétaro, the country is fast becoming an alternative base for U.S.-bound production.

The reasons are clear: rising costs in Asia, geopolitical instability, and a growing preference for regional supply chains. Combined with the benefits of the USMCA trade agreement, Mexico is now more than just a neighbor—it’s a strategic partner.

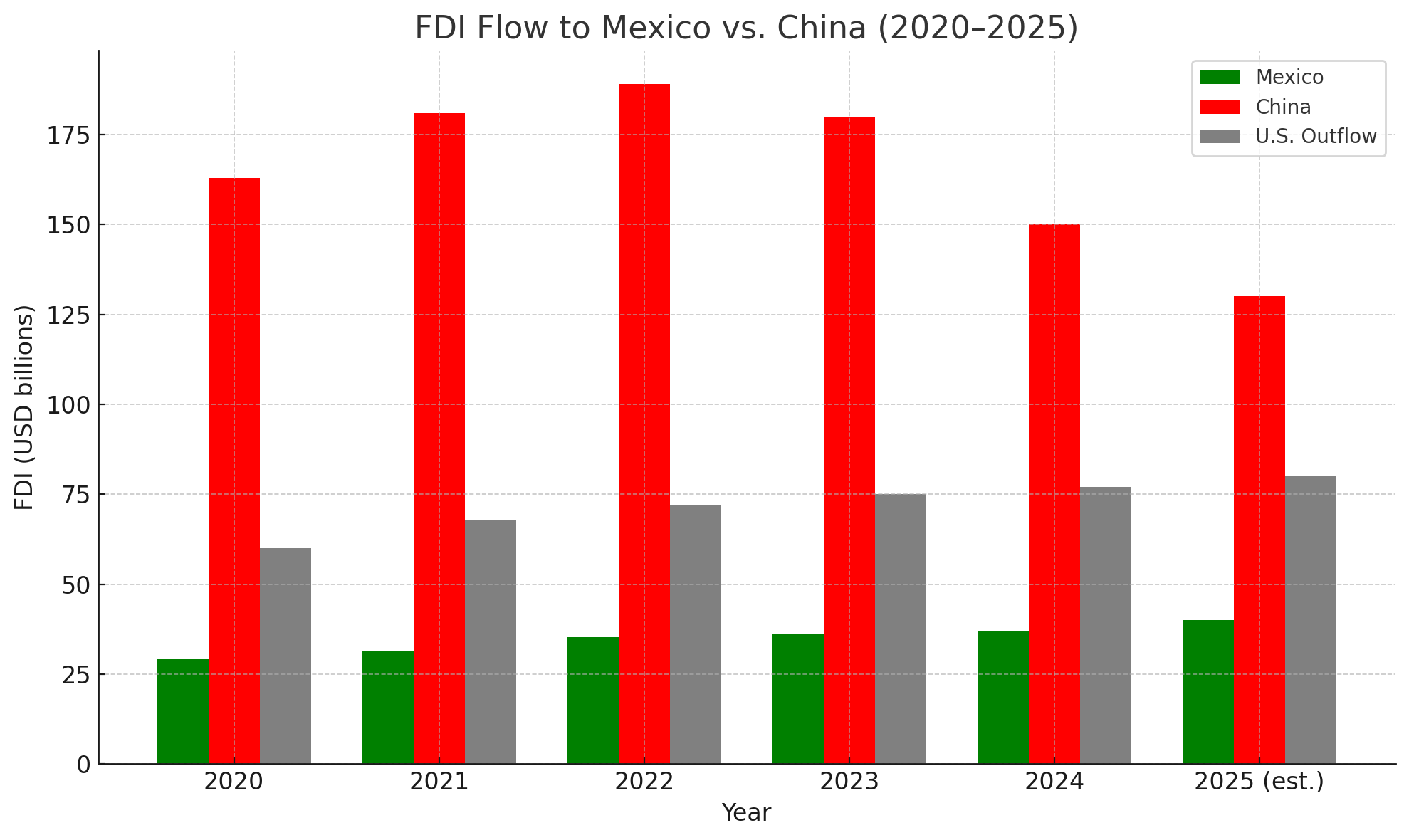

What the Numbers Show

Investment Momentum

Mexico’s foreign direct investment (FDI) has been on the rise, even as global capital flows have declined:

| Year | Total FDI Inflow | Key Observations |

|---|---|---|

| 2023 | $36 billion | Strong recovery post-COVID |

| 2024 | $37 billion | Ranked 11th globally despite global slowdown |

| Q1 2025 | $21.4 billion | 43% directed into manufacturing industries |

- Top sectors: EV parts, electronics, and energy infrastructure

- Auto parts alone brought in $2.5 billion, with electric components now accounting for over a third of exports

Companies on the Move

Several global players are betting big on Mexico:

- Tesla planned a $10 billion gigafactory near Monterrey, though progress is paused pending U.S. election outcomes

- Samsung’s Querétaro plant produces over 4 million smart appliances annually, most of which are exported

- Foxconn is setting up what may become the largest Nvidia-focused chip facility in the world

- TSMC, while not directly present, is reinforcing the North American chip supply chain through its massive U.S. expansion

From China to Mexico: The Trade Shift

As more production moves closer to the U.S., trade data reflects a clear shift:

| Metric | Mexico | China |

|---|---|---|

| Share of U.S. Imports | Rising steadily | Declining post-2022 |

| Auto Parts Trade Surplus | $26.39 billion (2024 Q3) | N/A |

| Average Delivery Time | 1–3 days | 2–4 weeks |

The proximity advantage alone allows companies to operate leaner supply chains and respond faster to consumer demand.

Beyond the Numbers

While Mexico isn’t replacing China outright, it’s becoming the first-choice destination for certain industries—particularly those that need quick turnaround times and tariff-friendly trade.

At the same time, the FDI into Mexico is still modest compared to China’s peak years. But what stands out is the direction of capital. While many economies are seeing capital flight or stagnation, Mexico continues to attract new commitments—especially from the U.S.

Challenges to Watch

Like any fast-growing market, Mexico has some critical gaps:

| Issue | Impact on Nearshoring Plans |

|---|---|

| Infrastructure | Many suppliers lack the certifications to serve high-tier EV firms |

| Labor Supply | Skilled manufacturing workers are in short supply |

| Political Risks | Tariff uncertainty slowed key projects like Tesla's |

| Security Concerns | Ongoing cartel activity disrupts logistics in some regions |

Unless addressed, these issues could limit the speed and scope of Mexico’s nearshoring momentum.

Key Takeaways for Investors

- Mexico is not trying to be "the next China"—it’s carving out a strategic niche, especially for U.S.-centric industries like EVs, semiconductors, and consumer electronics

- Industrial real estate, logistics, and cross-border trade infrastructure stand to benefit the most

- ETFs and funds with exposure to North American manufacturing are well-positioned to capitalize

- Challenges remain—but the upside is clear, especially if FDI crosses the projected $40 billion mark in 2025

Sources

- Mexico News Daily – FDI Ranking

- Indiplomacy – Record Q1 2025 FDI

- Tecma Group – Manufacturing Trends

- Foxconn–Nvidia Chip Facility News

- TradingEconomics – US-Mexico Exports

- Kearney – 2025 FDI Confidence Index (PDF)

- Baker Institute – Nearshoring Challenges

- Tesla Gigafactory – Wikipedia

- Samsung Querétaro Plant Report

- TSMC U.S. Expansion Announcement