Why Google Stock Is Lagging in 2025 – And Why That Might Be the Point

The most surprising underperformer in Big Tech—and what it’s really building.

/tag/Business & Markets

Summary

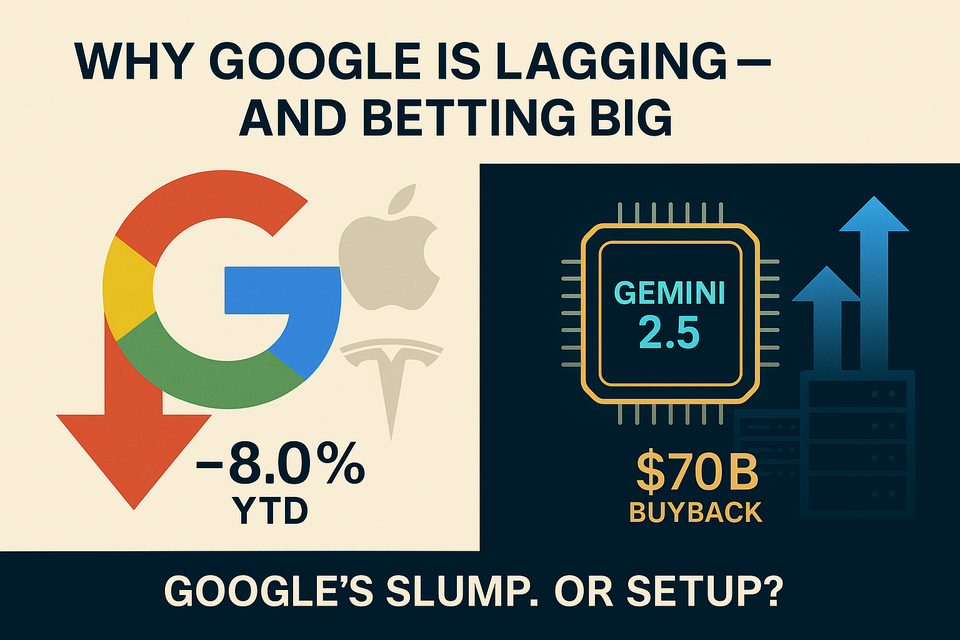

Google is still down over 8% YTD—along with Apple, Tesla, and Amazon.

But unlike the others, its fundamentals are strong: record earnings, rising margins, and AI expansion.

So what’s really behind the slump? Here’s what Wall Street’s missing—and why this might be a setup, not a stumble.

Introduction: The Tech Giant That Should Be Rallying

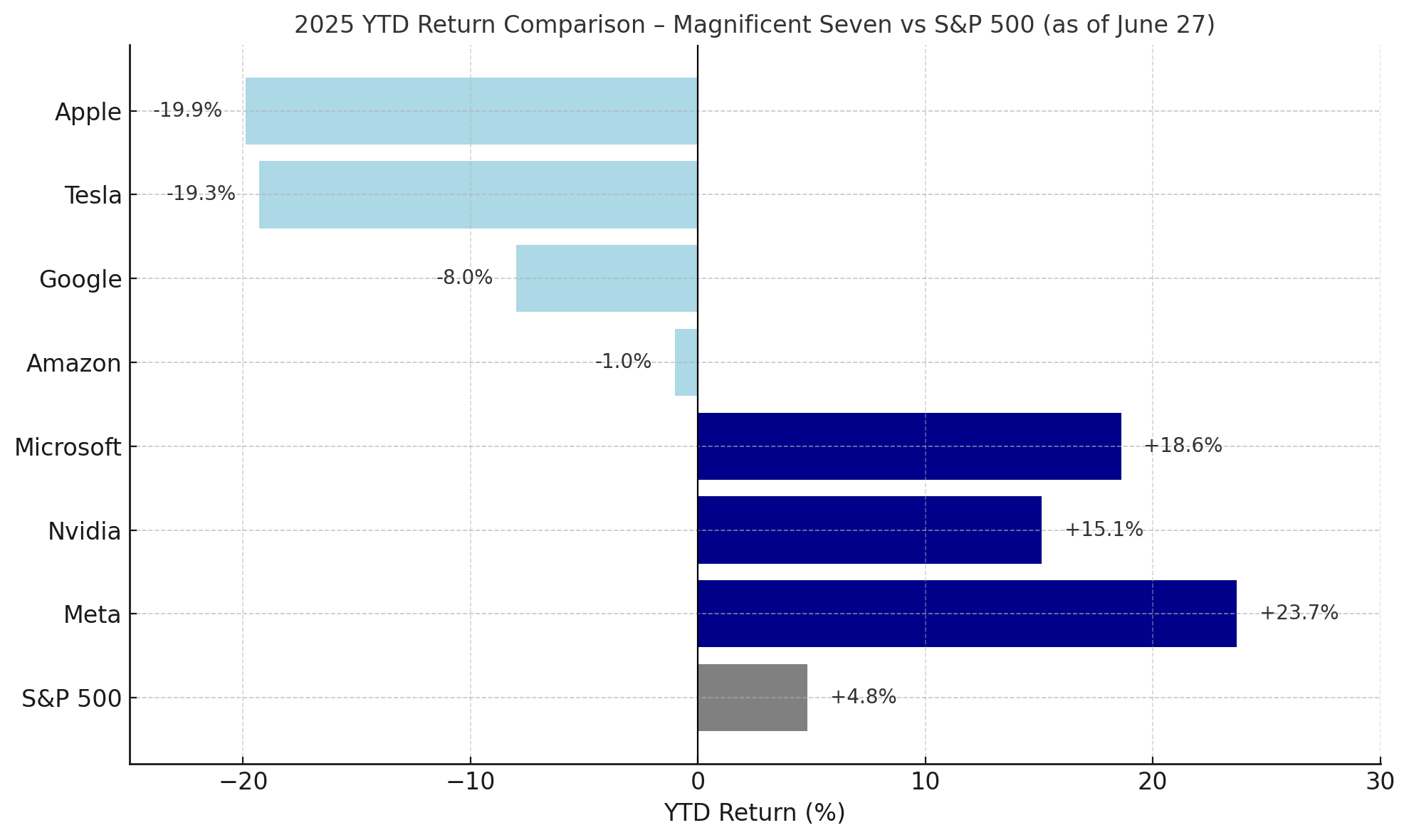

Meta is up. Microsoft is booming. Nvidia? Still riding the AI rocket.

Even Amazon, after years of post-pandemic whiplash, is almost back in the green.

And yet... Alphabet is down –8.0% YTD as of June 27.

Not the worst (Apple and Tesla are down nearly –20%), but certainly the most confusing.

The Numbers Behind the Dip

Let’s start here: this isn’t about bad performance.

In Q1 2025, Alphabet posted:

- $90.2B in revenue (above estimates)

- $2.81 EPS, comfortably beating forecasts

- +46% YoY net income growth

- 33.9% operating margin, its highest in years

Search is still a money printer—$50.7B last quarter.

YouTube nearly matched Disney’s entire media division with $9B in revenue.

Google Cloud is up +28% YoY, now margin-positive and expanding fast.

So… what’s the problem?

Perception.

What’s Weighing on Google

1. AI’s Existential Threat to Search?

There’s a loud camp on Wall Street saying:

“AI tools like ChatGPT are replacing search. If users stop Googling, ad dollars vanish.”

But let’s check the numbers:

- Google still owns ~90% of global search market share.

- ChatGPT’s “search traffic” equivalent? About 0.25%.

Even if you believe in the long-term AI shift, Google’s lead in query volume is 373x larger than its closest AI rival.

Plus, the company isn’t ignoring the threat—it’s embracing it:

- AI Overviews now serve up answers directly in Search.

- Gemini 2.5 powers an AI Mode that blends links, answers, and—surprise—ads.

Google’s not losing search. It’s redesigning it.

2. The Legal Wildcard

Now this is where things get thorny.

Alphabet is:

- Under fire for its ad tech dominance (judge ruled the model illegal in April)

- Facing DOJ threats to break up Chrome

- Still battling the search monopoly case, with pressure to change default settings and licensing terms

None of this is settled. But all of it creates uncertainty—and markets hate uncertainty.

The Comeback Blueprint: What Google’s Actually Doing

While sentiment sours, Google’s been quietly playing the long game.

Gemini 2.5

- Outperforms OpenAI on certain academic benchmarks

- Embedded across Google Search, Pixel, Android, Workspace

- AI Studio usage up 200%

- Building AI search not just for users—but for monetization

Infrastructure Stack

- Launching Ironwood TPUs, custom AI chips

- Investing $75B+ in data centers and cloud infrastructure

- Building full-stack AI from silicon to software, entirely in-house

Shareholder Moves

- $70B stock buyback announced in April

- Analysts remain bullish: consensus price target around $200–220

- That’s 15–25% upside from current levels

Why It Matters

Google’s decline might look like a red flag. But it may actually be a reset.

The company is quietly retooling:

- Making search AI-native

- Fortifying its cloud and hardware backbone

- Defending itself from regulatory dismemberment

In short, it’s playing for the next decade—not just the next quarter.

If Gemini continues to grow, and the courts don’t force a breakup, 2025 could age like a buying opportunity.

Or not. It’s Big Tech. There are always caveats.

Takeaways

- Google is –8% YTD, but it’s not alone—Apple, Tesla, and Amazon are all down.

- Earnings are strong, margins expanding, and YouTube/Cloud are surging.

- AI isn’t replacing search yet—and Gemini may end up enhancing it.

- Legal risks remain—but Google’s full-stack AI play and buybacks show long-term confidence.

- Among the “Magnificent Seven,” this might be the quietest—but smartest—setup in play.

Sources

- Alphabet Inc. (GOOGL) Stock Quote – Yahoo Finance

- Alphabet Q1 2025 Earnings Report – CNBC

- DOJ Seeks to Break Up Chrome – CNBC

- Global Search Engine Market Share – Statista

- Google Launches Gemini 2.5 in Search – The Verge

- Alphabet Announces $70 Billion Buyback – Reuters