Why Georgia Is Becoming a Powerhouse for Logistics Automation and Data Centers

Summary

Georgia is fast emerging as a hub for logistics automation and digital infrastructure.

With rising demand for AI-powered warehousing and surging data center construction,

the state is attracting major investments from cloud giants, robotics firms, and supply chain innovators.

Here’s what’s driving this momentum—and where new opportunities lie.

From EV Manufacturing Hub to Smart Infrastructure Core

Georgia’s manufacturing boom—led by EV giants like Hyundai—was just the beginning.

Today, the state is evolving into a next-gen logistics and data infrastructure hub,

fueled by strategic geography, low-cost utilities, and state-level incentives.

Now entering a phase of ecosystem expansion, Georgia is investing in

AI-powered supply chains, cloud infrastructure, and warehouse automation.

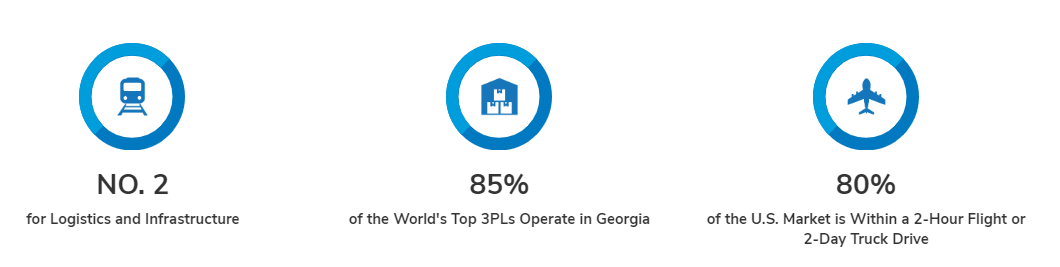

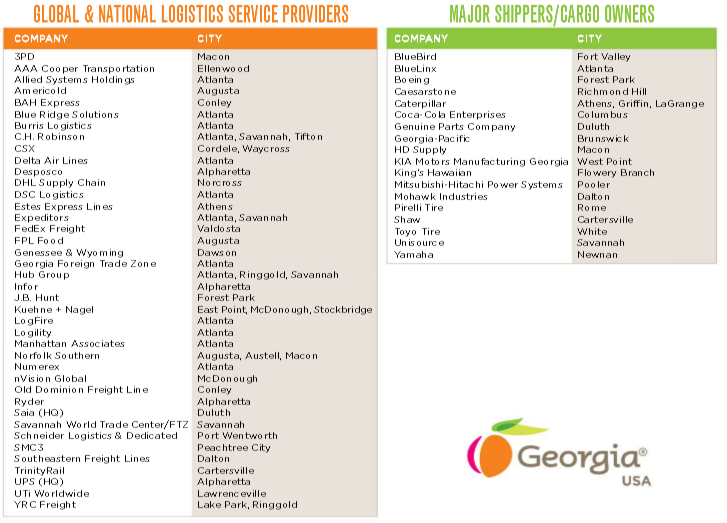

The Logistics Shift: Where Automation Meets Access

- $49.75B logistics market in 2025 → Projected to reach $59.64B by 2030

- Over 9,000 new logistics jobs created in 2 years

- 3,200+ active logistics facilities, including UPS, Delta, Saia HQs

- Infrastructure spend: $4.1B+ from federal/state over past 2 years

Automation is the core trend—from AGVs to AI inventory systems.

Key players are betting on Georgia’s location and infrastructure to build the future of fulfillment.

Spotlight Projects

- NewCold: $333M automated cold warehouse (for Conagra Brands)

- GreenBox Systems: $144M AI-powered warehouse rental model

- GXO Logistics: Deploying humanoid robots in Atlanta for live ops

Atlanta Surges to No.1 in U.S. Data Center Absorption

With AI and cloud adoption soaring, demand for hyperscale data centers is exploding.

In 2024, Atlanta overtook Northern Virginia with:

- 705.8MW net absorption (up 39x YoY)

- 2,159MW under construction (195% YoY growth)

- 1.9% vacancy rate (lowest ever recorded)

Georgia’s advantages:

- Below-average electricity costs

- High power reliability

- Ample land and low real estate costs

Top 10 North American Data Center Markets by Construction Volume (H2 2024)

Atlanta ranks second only to Northern Virginia in data center capacity under construction—highlighting its rise as a national leader in digital infrastructure.

| Market | H2 2024 Under Construction (MW) | H2 2024 Total Inventory (MW) |

|---|---|---|

| Northern Virginia | 2,672.5 MW | 2,930.1 MW |

| Atlanta | 2,159.3 MW | 1,000.4 MW |

| Dallas-Fort Worth | 605.6 MW | 591.0 MW |

| Austin/San Antonio | 463.5 MW | 191.1 MW |

| Chicago | 266.0 MW | 640.9 MW |

| Phoenix | 176.0 MW | 602.8 MW |

| Silicon Valley | 167.8 MW | 468.4 MW |

| Hillsboro | 160.8 MW | 499.0 MW |

| New York Tri-State | 142.1 MW | 190.0 MW |

| Montreal | 11.0 MW | 214.5 MW |

Source: CBRE

Major Investments:

- AWS: $11B for AI infrastructure expansion

- Microsoft: $80B global cloud + AI spend

- QTS, Stream, DC Blox, Lincoln Property all expanding in Atlanta

Why It Matters

Georgia is redefining what a U.S. growth state looks like in the age of automation and AI.

For industry leaders, investors, and innovators, the state now offers:

- A central logistics gateway with scalable automation infrastructure

- A rapidly growing market for cloud services and data infrastructure

- Cross-sector opportunities in robotics, energy, software, and real estate

This isn’t just regional momentum—it’s a signal of where tech-integrated physical infrastructure is headed.

Takeaways

- Georgia is scaling from EV manufacturing to smart infrastructure

- Atlanta is now the top U.S. data center growth market

- Investment in automation and AI logistics is accelerating

- The state offers unmatched synergy across logistics, cloud, and energy sectors