Why Gen Z Is Ditching Credit Cards—and What It Means for Fintech

Summary

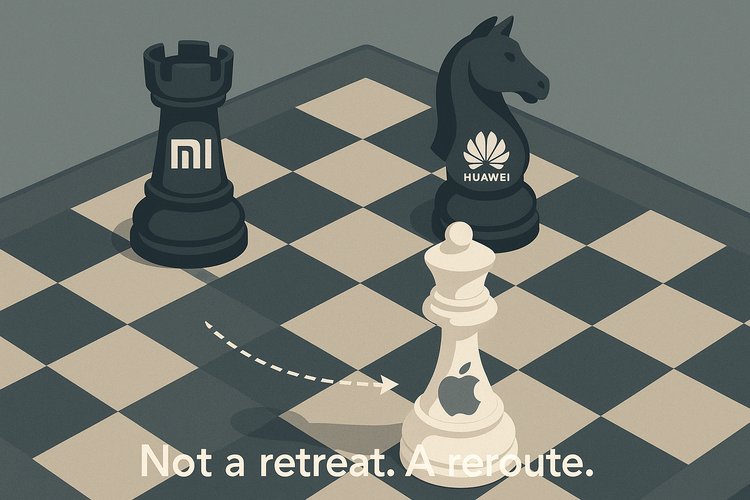

Gen Z is rapidly shifting away from traditional credit cards.

From BNPL services to mobile wallets, they’re rewriting the rules of consumer finance.

This isn’t just a trend—it’s a transformation.

Here’s what’s replacing plastic, and why it matters.

Gen Z’s Wallet Revolution: Beyond the Credit Card

A. Introduction

84% of Gen Z had at least one credit card in 2023—but how they use it is changing fast.

Rather than rely on revolving debt, they are gravitating toward interest-free, mobile-first, and instant payment tools like BNPL and digital wallets.

According to TransUnion, Gen Z's credit balances are rising faster than any other group, yet delinquency is also increasing. The takeaway? This generation is still spending—but doing so on their own terms.