Why Credit Card Companies Are Doubling Down on Premium

The Economics Behind the Annual Fee Hikes

Summary

Chase just raised the annual fee on its Sapphire Reserve. But this isn’t just about inflation—it’s part of a broader shift across the credit card industry. Here’s why card issuers are betting on fewer, richer customers—and what it means for investors.

Introduction: When Loyalty Gets Expensive

In June 2025, Chase shocked the market by raising the annual fee on its Sapphire Reserve card from $550 to $795. That’s not a tweak—it’s a 45% hike on one of the most widely used premium travel cards in the U.S. American Express, Capital One, and Citi have followed similar patterns.

These changes are not isolated. They signal a strategic pivot toward high-income customers and away from volume-driven growth. In a world of rising costs, fintech competition, and shifting consumer behavior, the economics of the credit card industry are being rewritten.

Trend Breakdown

1. Fee Inflation Is Real—and Intentional

Over the last 24 months, nearly every major card issuer has increased annual fees across premium products:

- Chase Sapphire Reserve: $450 → $550 (2020) → $795 (2025)

- Amex Gold: $250 → $325 (2024), with rumors of a Platinum jump to $895 in 2025

- Capital One Venture X: Still $395, but lounge access limited to fewer guests and authorized user fees increased

According to CFPB data, the average annual fee for accounts with fees rose to $105 by 2022, up from $62 in 2015. Over the same period, total annual fee revenue doubled from $3 billion to $6.4 billion.

Issuers aren’t just adjusting for inflation—they’re rebalancing margins away from risky interest-based models and toward predictable fee revenue.

2. Fewer Customers, Higher Margins

The math is simple: fewer customers, each delivering more revenue. And it starts with targeting high-income users.

| Income Group | Card Ownership | Carries Balance? | Avg. Credit Card Debt |

|---|---|---|---|

| $100K+ | 98% | 37% | $11,210 |

| <$25K | 68% | 56% | $3,800 |

Amex reports that 70% of new accounts in Q1 2024 were fee-based. Millennials and Gen Z now make up over 60% of new account signups—these are not entry-level customers. They’re entering credit with income, travel expectations, and brand loyalty.

Premium cardholders carry fewer balances but are far less likely to churn—if the perks hold up.

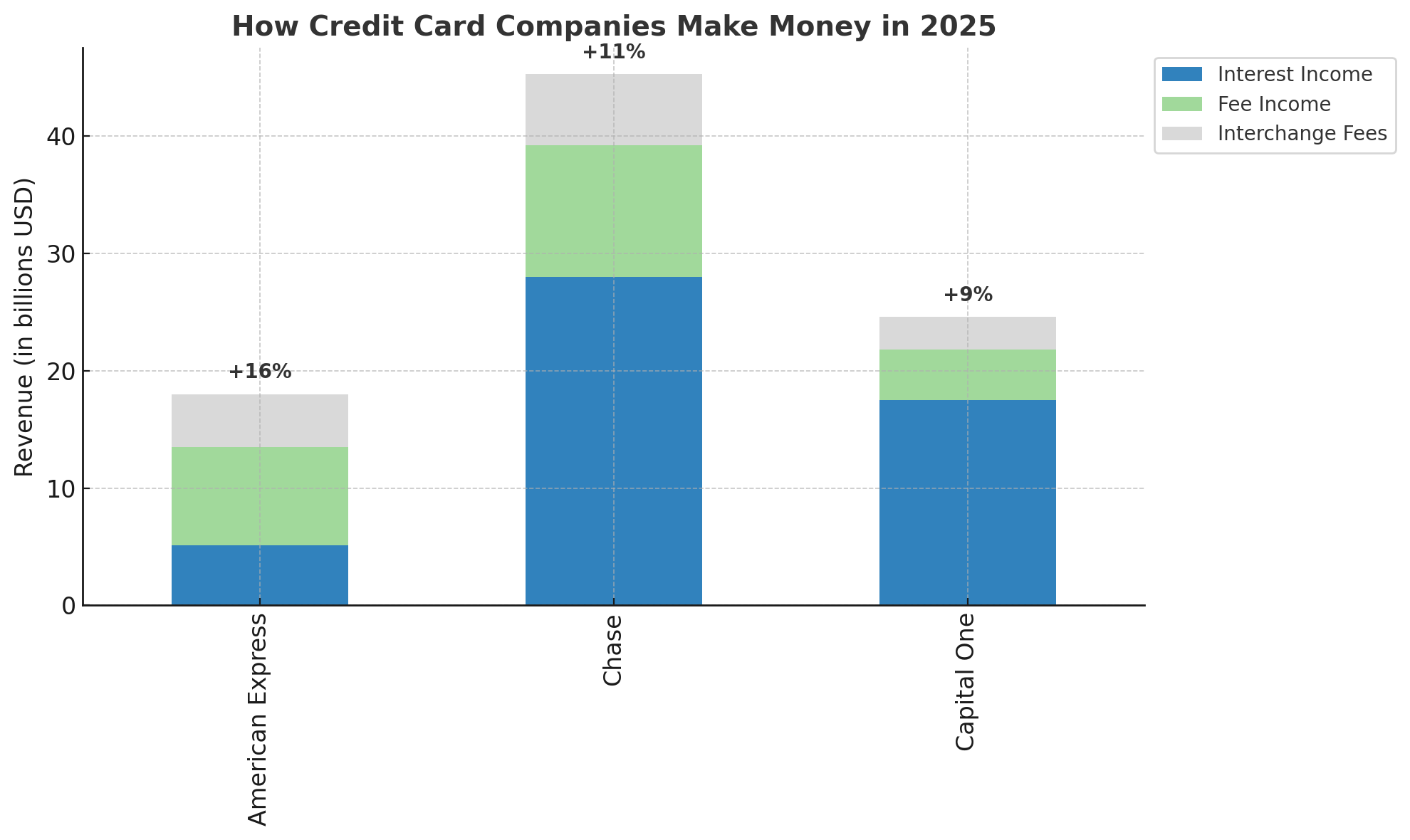

3. The Shift in Revenue Model

Credit card companies once relied heavily on interest income from revolving balances. But as younger, higher-income users shift away from carrying debt, the economics of the business are evolving.

Key Streams of Revenue:

- Interest Income: Still dominant among subprime borrowers, but less relevant among premium users

- Interchange Fees: 1–3% of transactions, depending on merchant category and network

- Annual Fees: Now a primary profit driver among the top decile of users

For example:

- Amex generated $8.4 billion from annual fees in 2024—a 16% increase from the previous year.

- JPMorgan Chase’s Consumer Banking division earned $71.5 billion in revenue in 2024—nearly 44% of company-wide revenue

For premium-focused banks, annual fees are no longer ancillary—they’re central.

The chart below illustrates how Amex, Chase, and Capital One are reshaping their revenue models—and highlights just how central fee income has become to their strategy.

4. The Loyalty Squeeze

The value of credit card points has declined by 15–20% since 2019. Airline miles required for a domestic round-trip rose over 500% in some cases.

Meanwhile, cardholders are accumulating more points than ever: over $34 billion in unredeemed points sat on issuer balance sheets by 2023.

In response, issuers are:

- Offering merchant credits (e.g. Uber, DoorDash)

- Bundling lifestyle perks (e.g. dining, streaming)

- Tightening redemption windows or blackout dates

This creates the illusion of value while controlling redemption liability.

5. Competitive Pressures from Fintech

The “fee-free” movement is no longer fringe:

- Apple Card offers no annual fees and instant cashback

- BNPL adoption has surged 2x since 2020

- Gen Z prefers debit: 69% use it weekly vs 39% using credit

Card issuers are responding:

- Chase MyPlan, Amex Plan It, and Citi Flex Pay mimic BNPL structures

- Statement credits are now framed more like discounts than rewards

The future credit customer is digital, mobile-native, and resistant to opaque fee structures.

Why It Matters

Premium strategies help issuers stabilize cash flows, reduce risk exposure, and differentiate in a saturated market. But it’s not without trade-offs:

- Relying on fewer high-value customers increases churn sensitivity

- Regulatory scrutiny around transparency, especially from the CFPB, is rising

- Younger users are increasingly skeptical of legacy reward models

For investors, tracking fee revenue growth is becoming more important than interest yield.

Takeaways

- Credit card issuers are prioritizing revenue from annual fees over interest

- Premium products are central to retention, loyalty, and margins

- Fintech and inflation are forcing traditional banks to rethink loyalty economics

- Investors should watch the composition of credit card revenues—not just top-line growth

Sources

- NerdWallet

- CFPB

- The Points Guy

- PaymentsDive

- American Express IR

- Visa Insights

- DBRS Morningstar

- Bankrate

- Mastercard

- CNBC

- Helcim

- LinkedIn Research