U.S. Markets in June 2025: Between Resilience and Risk

Summary

As we cross the midpoint of 2025, the U.S. financial markets find themselves at a delicate intersection. On one hand, inflation is slowly cooling, AI-driven equities are soaring, and consumer demand remains reasonably intact. On the other, policy uncertainty lingers, geopolitical tensions are simmering, and capital flows show signs of strain. Let’s take a closer look at where things stand—and what’s likely ahead.

The Fed Holds Steady, But the Debate Heats Up

At its June meeting, the Federal Reserve kept interest rates unchanged for the fourth time in a row, holding the target range at 4.25% to 4.50%. While this decision was widely expected, the internal divisions within the Fed are growing more pronounced.

Seven of the 19 FOMC participants now anticipate no cuts in 2025—a significant increase from just four in March. Fed Chair Jerome Powell underscored a “wait-and-see” approach, citing stubborn inflation and softening labor data. The latest Summary of Economic Projections still points to two rate cuts by year-end, but with increasing hesitation.

Futures markets reflect this ambivalence. There’s near-zero expectation of a rate move in July, with September being eyed as the earliest likely window. Most traders now expect just one or two cuts before the end of 2025.

Inflation Slows, Labor Market Holds—but Cracks Are Emerging

Inflation continues its gradual descent. May’s headline CPI came in at 2.4% year-over-year, with core inflation slightly higher at 2.8%. Energy prices fell again, helping keep overall numbers in check. June’s CPI is projected to come in around 2.6%.

On the labor front, unemployment has held steady at 4.2% for three straight months, while job creation in May added 139,000 new positions. That said, labor force participation has edged lower, and continuing jobless claims have crept up to levels not seen in three years. Wages are still rising (+3.9% YoY), but at a more modest pace than earlier this year.

Markets Rally, But Valuation Anxiety Creeps In

Equities have powered ahead since spring. The S&P 500 crossed 6,000 in early June and is up over 5% in May alone—its best monthly showing since 2023. Nasdaq stocks, powered by AI optimism, continue to drive much of the rally. Nvidia, for instance, surged 18% in May.

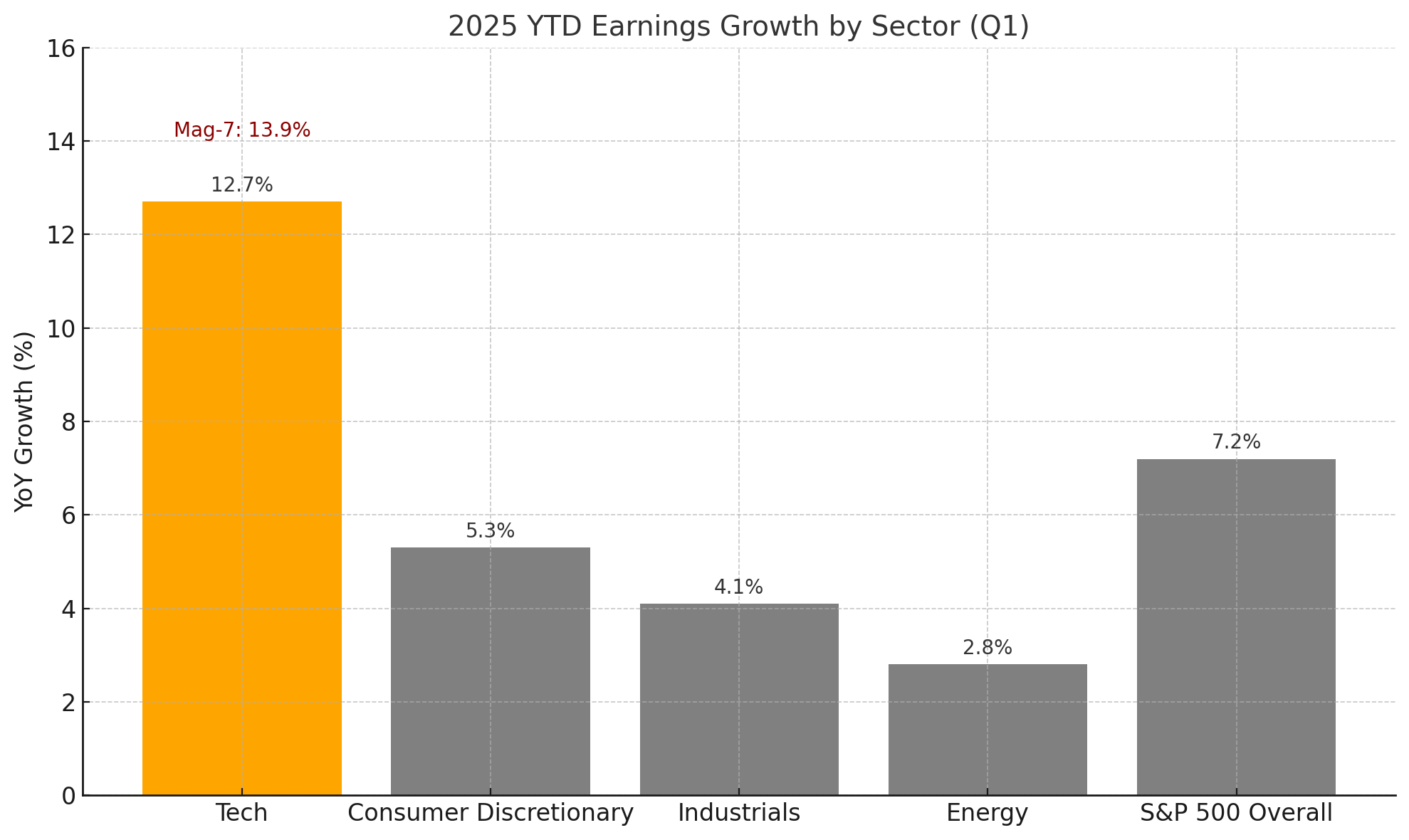

First-quarter earnings season further supported the momentum. Tech companies posted nearly 13% earnings growth, far outpacing the broader market. The so-called “Magnificent Seven” delivered even stronger results.

See chart: 2025 YTD earnings growth by sector

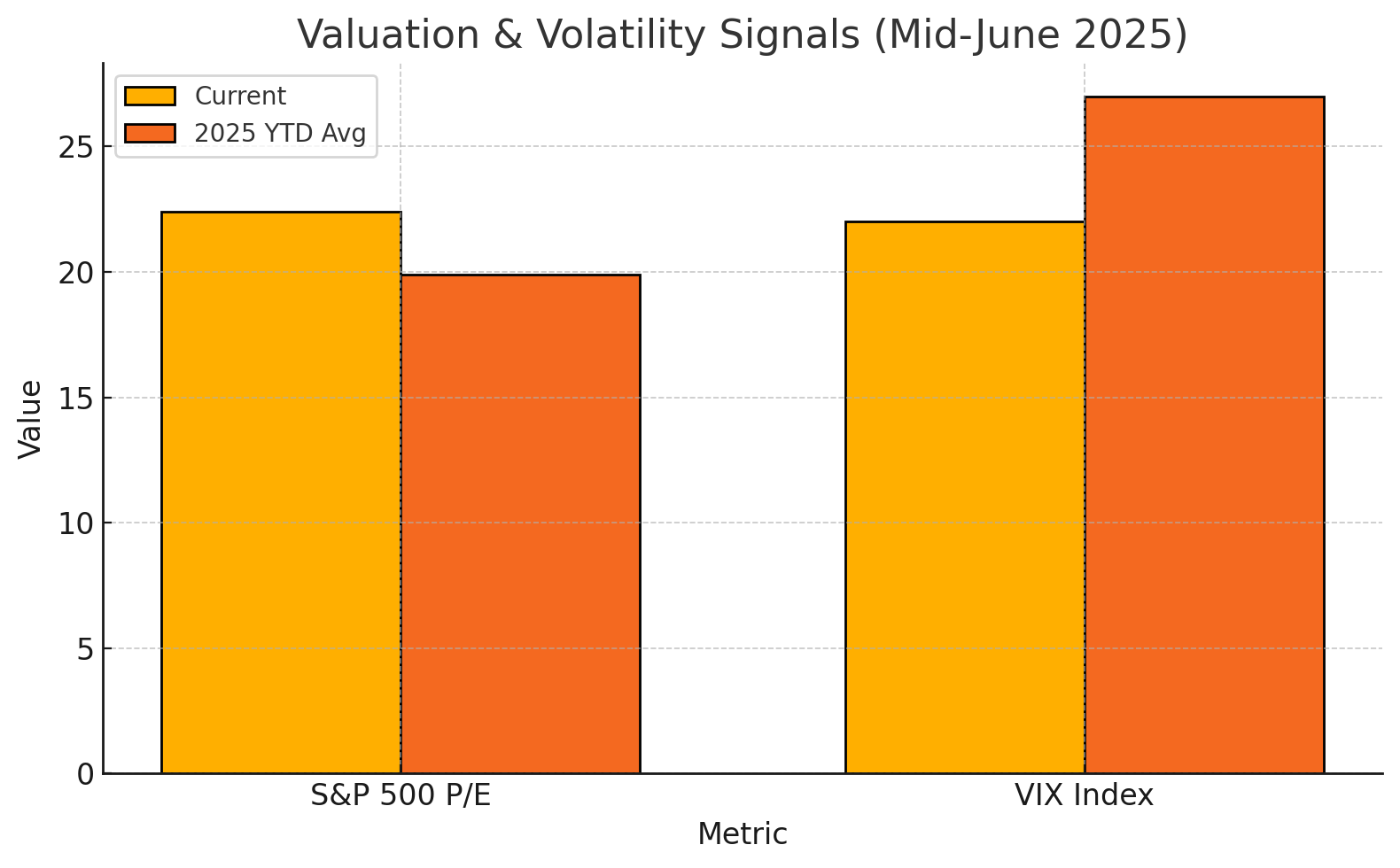

But beneath the surface, concerns remain. Valuations are stretching. The S&P 500 now trades at over 20x forward earnings, a level that historically leaves little room for disappointment. Volatility, too, remains elevated. The VIX hovered around 22 in mid-June, with a 2025 average closer to 27—well above normal.

| Metric | Current | Historical Context | Risk Signal |

|---|---|---|---|

| S&P 500 P/E | ~22.4× | Above 5-yr & 10-yr avg (~19.9) | High valuation = limited upside |

| VIX (Volatility) | 20–22 | Below 2025 avg (~27) | Still elevated = risk remains |

Current market signals highlight both confidence and caution. Elevated valuations suggest investor enthusiasm, but persistent volatility hints at underlying unease.

Capital Flows and Investor Sentiment: Mixed Signals

Foreign investors have quietly reduced their exposure to U.S. stocks, selling more than $60 billion worth since March. European institutions led the exit, while Asian and Middle Eastern funds remained net buyers. On the fixed income side, short-term Treasury funds attracted inflows, while longer-duration bond funds saw continued outflows—signaling caution about rates and inflation.

Investor sentiment has turned more risk-on in recent weeks, as tariff delays and AI momentum bolstered confidence. State Street’s Risk Appetite Index rose to its highest level since February.

AI Boom Keeps Markets Afloat—for Now

Artificial intelligence remains the most dominant market theme in 2025. Google’s new Gemini 2.5 Pro release, OpenAI’s hardware acquisition, and record-breaking AI startup funding continue to support investor enthusiasm.

Large-cap names like Nvidia have become staples of any AI portfolio, but analysts are increasingly pointing to mid-cap and software names as the next wave of opportunity. However, a shift is underway—from hype to execution. Investors now expect real revenues and profits, not just vision.

Trade Deals and Tax Cuts: Tailwinds or Traps?

A U.S.-China trade agreement in early June helped reduce tariffs on both sides, cooling tensions. But the effective tariff rate remains high at 15.8%, and household goods like clothing and footwear are still seeing steep price hikes. Any breakdown in this fragile détente could quickly reignite market volatility.

Meanwhile, Washington is working on a massive fiscal package that could cut taxes by $4.8 trillion over the next decade. While this may support short-term growth, the long-term implications for debt sustainability remain a concern.

Outlook: What to Watch in 2H 2025

Markets are caught between hope and hesitation. AI and tech earnings are fueling the upside. But persistent inflation, policy ambiguity, and geopolitical risks hang in the background. Key variables to track include:

- Whether inflation continues moderating toward the Fed’s 2% target

- Timing and messaging of any future Fed rate cuts

- Sustainability of tech-led equity leadership

- Capital flows, particularly foreign demand for U.S. assets

- Outcomes of trade negotiations and fiscal legislation

For now, investors appear cautiously optimistic—but the road ahead remains anything but smooth.

Sources

- CNBC: Fed holds rates steady – June 2025

- Investopedia: June 2025 Dot Plot Summary

- Federal Reserve FOMC Projections Table – June 2025

- FOMC Press Conference Transcript – June 2025

- CME FedWatch Tool

- Forbes: Rate Cut Expectations for Remainder of 2025

- BLS May CPI Report

- Cleveland Fed Inflation Nowcast

- Actalent Labor Market Report – May 2025

- TradingEconomics: Jobless Claims – June 2025

- Investopedia: S&P 500 Breaks 6,000 – June 2025

- Yahoo Finance: Nvidia May 2025 Performance

- AINVEST Q1 2025 Earnings Preview

- Bloomberg: $63B Foreign Outflows from U.S. Equities

- Reuters: Treasury Fund Flows – April 2025

- State Street Risk Appetite Index – May 2025

- CBOE VIX Historical Data

- Investopedia: Best AI Stocks in 2025

- NatLaw Review: AI VC Funding 2024–2025

- Business Insider: Emerging Small-Cap AI Stocks

- Reuters: U.S.–China Trade Deal – June 2025

- Yale Budget Lab: Tariff Impact – June 2025

- Tax Foundation: Trump Tax Reform Proposal – 2025