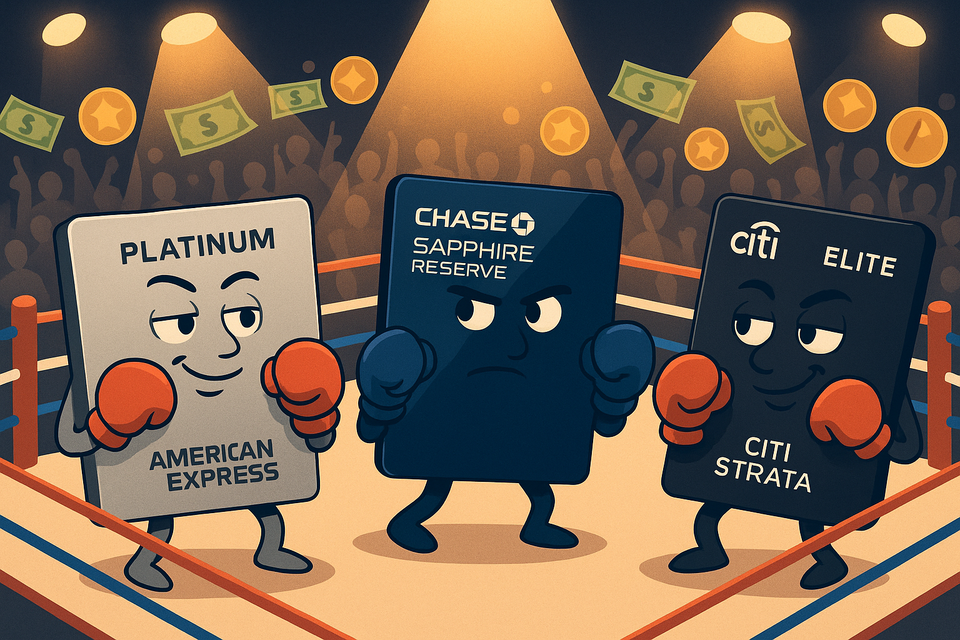

The Premium Credit Card War: Why Citi, Chase, and Amex Are Aggressively Competing in 2024–2025

Summary

The premium credit card market is heating up — fast. Citi just launched the Strata Elite to compete with Amex Platinum and Chase Sapphire Reserve. But why are banks suddenly obsessed with $600+ cards? This post breaks down the economics, the psychology, and the not-so-secret reason you’re seeing so many metal cards lately.

Market Forces Driving Premium Card Competition

Explosive Growth and Profit Margins

The global premium credit card market surpassed 120 million users in 2024, with the total credit card payment market valued between $530B and $622B, and projected to grow to $1.04T–$1.43T by 2032–2034, growing at a CAGR of 7.8%–8.7% (SkyQuest, Precedence Research, Straits Research).

Why does that matter? Because premium card customers are the juicy part: they pay fees, they spend heavily, and — crucially — they’re loyal.

The Rich Are Spending More Than Ever

According to Moody's Analytics, the top 10% of U.S. households (those earning $250,000+) now account for 50% of all consumer spending, up from just 36% a few decades ago. Even in uncertain times, these high earners keep swiping — especially for travel and dining.

Credit Cards Have a Margin Problem — Except at the Top

Standard credit cards average a 3–4% ROA (return on assets). Premium relationship-based cards? Over 6% (Corserv). American Express, for example, reported a 20.7% net margin in Q1 2025, with 70% of new accounts coming from premium products (Kavout).

The New Playbook: Higher Fees, Bigger Perks, More Control

Fee Inflation Is Real

Chase bumped the Sapphire Reserve fee from $550 to $795 in 2025 (Reddit). Amex increased the Gold Card from $250 to $325, and most recently, is expected to raise the Platinum fee to $995 (Thrifty Traveler, Morningstar).

The logic? If customers are still paying, just keep going — and bundle in perks to match.

Why Are Younger Rich People Paying?

Because they're not just buying rewards. They're buying identity. Amex says Millennials and Gen Z now drive 33% of total spend — and that number is growing fast (McKinsey). These customers value lounge access, concierge service, and exclusivity more than simple cashback.

Citi, Chase, Amex: Three Strategies, One Goal

Citi Strata Elite

Citi's new Strata Elite card is priced at $595 and offers $1,500+ in credits, including hotel, “splurge,” chauffeur, and lounge access. But the real kicker? It’s the only card with direct 1:1 AA miles transfer, plus 6x dining points on weekends (RollingOut, PYMNTS).

Chase Sapphire Reserve

Chase upped its fee to $795 but also loaded in $2,700+ in annual value, including 8x travel portal points, Apple credits, StubHub perks, and even Platinum status at IHG (Chase).

Amex Platinum

Still the king of luxury. Now priced at $995 (expected), and you get Centurion Lounge access, elite hotel statuses, exclusive concierge upgrades, and lifestyle credits worth over $1,400 annually (The Points Guy, Amex).

Premium Credit Card Comparison (2025)

| Card | Annual Fee | Benefits Value | Lounge Access | Unique Feature |

|---|---|---|---|---|

| Citi Strata Elite | $595 | ~$1,500 | Priority Pass + AA | 6x dining (Fri-Sat), AA 1:1 transfer |

| Chase Sapphire Reserve | $795 | ~$2,700 | Priority Pass | 8x Chase Travel, Apple + StubHub credits |

| Amex Platinum | $995 (est.) | ~$1,400+ | Centurion + others | Hotel elite status, concierge + event perks |

But Are All These Credits... Too Much?

Here comes the fatigue. As MarketWatch and Welcome.comperemedia note, many users are overwhelmed by fragmented credits they have to track, activate, and redeem. The future may lean toward automatic, simpler rewards.

Behind the Scenes: Revenue Math and Market Control

- Interchange fees (1.29%–3.5%) are still a huge moneymaker (FlexPoint)

- Visa: 57% profit margin in 2024; Mastercard: 43% (PaymentsJournal)

- Customer acquisition for premium cards is expensive (~$500–700 per user), but the lifetime value makes it worth it (Userpilot)

What Comes Next?

- Cards might hit the $1,000 fee threshold by 2026 (Morningstar)

- Premium benefits will get more personalized, AI-driven, and embedded in lifestyle

- Regulation (like the Credit Card Competition Act) might pressure interchange margins — so expect even more aggressive fee and benefit bundling

Final Thought

You’re not just paying $995 for a card. You’re paying for status, for dopamine at the airport lounge, and for a digital concierge who knows your steak order. Whether that’s worth it… is up to your travel calendar.

But for Citi, Chase, and Amex? It’s already worth billions.

Sources

- SkyQuest – Global Credit Card Market Report

- Straits Research – Credit Card Payment Market Size

- Moody's via Sageview – How Wealthy Consumers Are Propping Up the Economy

- Corserv – 5 Steps for Banks to Improve Credit Card Programs

- Kavout – American Express Bullish Outlook

- PYMNTS – Citi Enters Luxury Card Market

- Chase – Sapphire Reserve Official Benefits

- The Points Guy – Maximizing Amex Platinum

- American Express – Platinum Card Benefits

- Userpilot – Customer Acquisition Cost Data

- Morningstar – Amex Platinum Fee May Rise to $995

- NERA – Credit Card Competition Act Impact Analysis

- Thrifty Traveler – What Will the Refreshed Amex Platinum Look Like?

- MarketWatch – Citi’s Strata Elite vs Competitors

- Welcome by Comperemedia – How Premium Credit Cards Are Being Reshaped

- FlexPoint – Interchange Fee Breakdown

- PaymentsJournal – Credit Card Issuer Profit Strategy

- Reddit – Chase Sapphire Reserve New Benefits Leak

- McKinsey – State of the Consumer Report

- RollingOut – Citi Thinks You’ll Pay $595