Tesla vs. Waymo: Which Robotaxi Vision Will Win the Road?

Summary

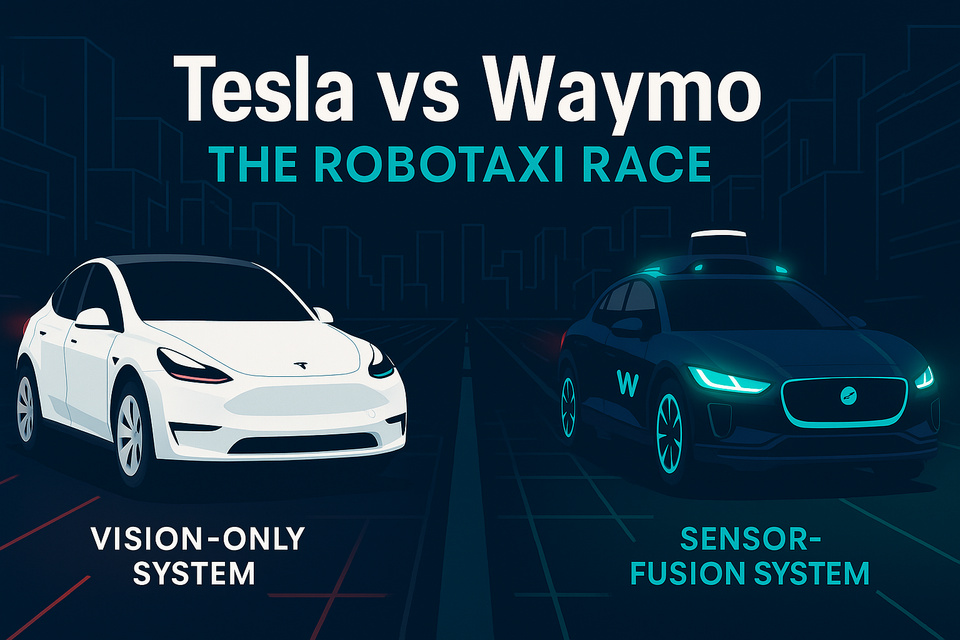

Tesla and Waymo are leading very different races in the robotaxi arms race.

Tesla’s new launch in Austin shows promise—but remains limited in scale and autonomy.

Waymo, on the other hand, is quietly scaling a profitable, driverless business across major U.S. cities.

So which model is more commercially viable? The answer lies in the data—and the timeline.

Introduction: A Diverging Road to Autonomy

In June 2025, Tesla officially launched its robotaxi service in Austin with a handful of vehicles and a bold promise: to scale a fully autonomous ride-hailing network faster than anyone else. But the launch also reignited a comparison long brewing in the self-driving world—Tesla’s camera-only, vision-driven approach vs. Waymo’s slow-but-steady, sensor-heavy model.

The commercial viability of robotaxis isn’t just about technology—it’s about regulation, economics, consumer adoption, and time-to-scale. And in that contest, the numbers tell a compelling story.

Trend Breakdown

1. Deployment Status: Pilot vs. Scale

| Company | Vehicles in Service | Cities Covered | Rides per Week | Driverless? |

|---|---|---|---|---|

| Tesla | 10–20 | 1 (Austin) | Unknown | No |

| Waymo | 1,500 | 4 (SF, LA, PHX, AUS) | 250,000+ | Yes |

Waymo operates a mature network, fully driverless, with over 5M rides completed. Tesla’s pilot, while headline-worthy, remains tightly geofenced with safety monitors onboard.

2. Economics: Price, Cost, and Profitability

| Metric | Tesla | Waymo |

|---|---|---|

| Price per Ride | $4.20 flat | $20.43 avg |

| Cost per Mile (est.) | $0.25–$0.40 | $0.50–$1.00 |

| Revenue per Vehicle (annual) | ~$15,330 | ~$177,060 |

| Hardware Cost per Vehicle | ~$40K | ~$175K |

Tesla may have cost advantages, but Waymo’s current economics deliver far higher per-vehicle returns.

3. Technology: Level of Autonomy

- Tesla: Level 2 autonomy with safety driver, using FSD software and camera-only setup.

- Waymo: Level 4 autonomy with no driver needed in geofenced areas, using cameras, LiDAR, and radar.

Waymo’s safety record includes 88% fewer injury crashes than human drivers.

4. Regulation & Risk

- Tesla faces global regulatory friction: FSD rollout paused in China, EU delays, and U.S. permits restricted to supervised trials.

- Waymo holds full CPUC deployment licenses, with zero regulatory objections to its recent expansions.

5. Scaling Strategy

- Tesla: Plans to transform customer-owned cars into robotaxis. Ambition: 1M+ vehicles/year.

- Waymo: Centralized growth via factory expansion in Arizona, targeting 3,500 vehicles by 2026.

Tesla’s crowdsourced scaling vision faces market and behavioral headwinds.

Why It Matters

The race to dominate autonomous mobility isn’t just about who gets there first—it’s about who builds a viable, profitable business at scale. Tesla’s upside is enormous, but so is its risk profile. Waymo’s slow and steady model may lack flair, but it’s proving that autonomy can already work—safely and commercially.

For investors, regulators, and operators, the question isn’t “who has the better tech?”—it’s “who can make this sustainable?”

Takeaways

- Tesla's robotaxi launch is real—but limited. Still SAE Level 2, with safety drivers and small pilot scope.

- Waymo is quietly winning the commercial game. High revenue per vehicle, regulatory approval, and zero human drivers.

- The winner may not be first to launch—but first to profit.