Switzerland's Deep-Tech Goldmine – Why the Alpine Nation Is Dominating Science-Driven Innovation

Summary

Switzerland is quietly becoming a global deep-tech superpower. With over $100 billion in enterprise value from 1,500+ startups, and 60% of all VC funding flowing into science-based innovation, it's no longer just about chocolate and watches. Here's a data-driven look at how it's happening—and what it means for investors, founders, and policymakers.

Introduction

Switzerland, population under 9 million, is punching far above its weight in deep-tech. As of 2025, it leads the world in per capita VC investment into deep-tech, with a staggering 60% of all venture dollars directed into science-driven startups. While the U.S. and China fight over AI dominance, the Swiss are quietly building quantum startups, carbon capture tech, and robotics unicorns—fueled by research powerhouses like ETH Zurich and EPFL.

Trend Breakdown

The Numbers

- 1,500+ deep-tech startups

- $100B+ in total enterprise value

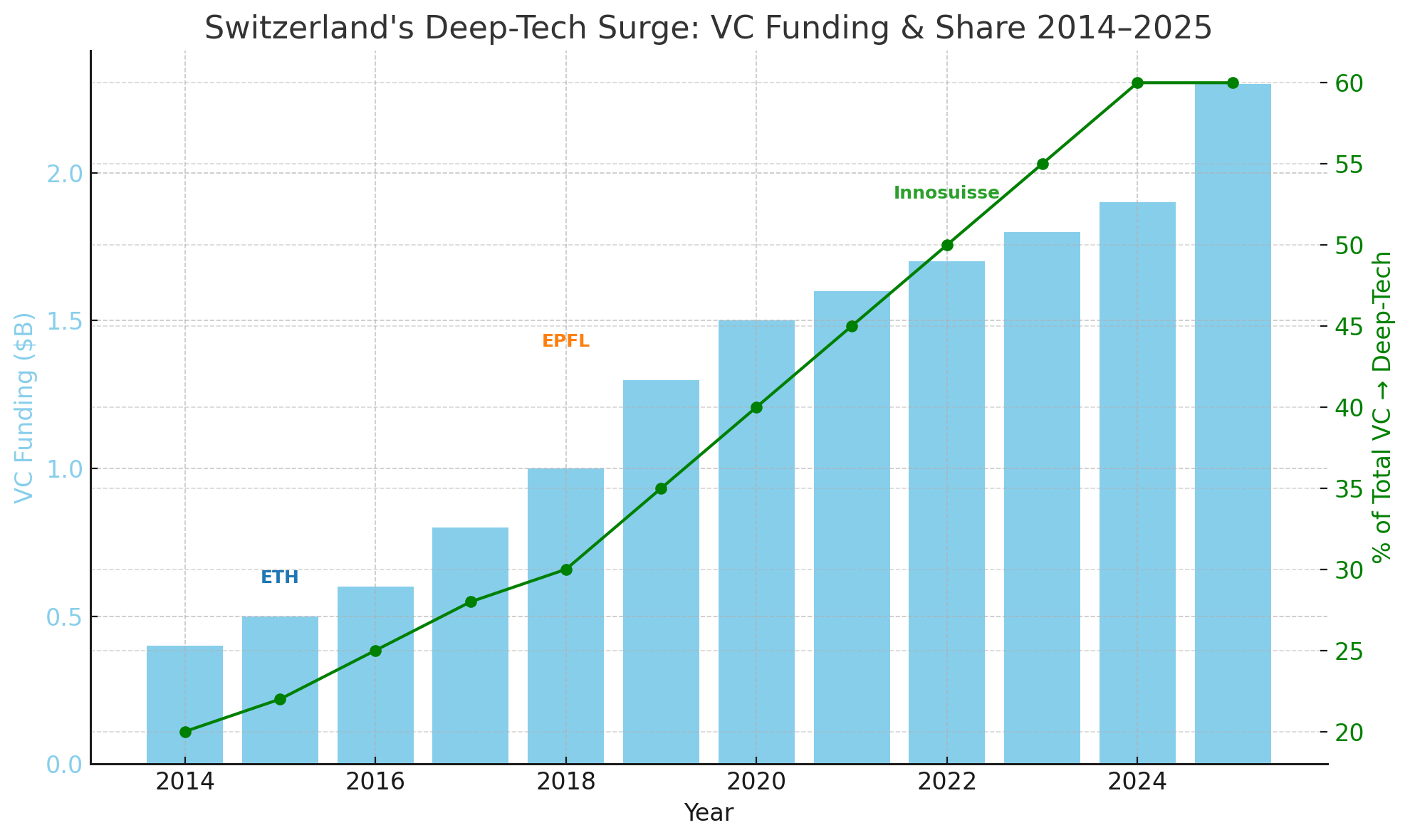

- $1.9B in VC funding in 2024, projected $2.3B in 2025

- Deep-tech share of VC funding: 60% (world’s highest)

Sector Diversification

| Sector | Funding Share (2024) | Notable Startups |

|---|---|---|

| AI/ML | 33% | Lakera, EthonAI, Jua |

| Biotech | 45% | Alentis, Asceneuron, iOnctura |

| Cleantech | ~15% | Neustark, terralayr |

| Robotics | Growing | ANYbotics |

| Quantum | Early-stage | ZuriQ, Terra Quantum |

Funding Trends

- AI funding doubled YoY (2023 → 2024)

- Health sector received CHF 1.04B (45% of total)

- ANYbotics raised €104M in Series B (robotics milestone)

- 96% of late-stage funding led by international investors

Why It Matters

- Switzerland is the lab-to-market model perfected

With ETH and EPFL spinning out dozens of startups yearly and Innosuisse backing commercialization, it’s one of the few places where science reliably becomes product. - International capital is betting on Swiss IP

U.S. and EU firms dominate late-stage funding rounds, indicating global confidence in Swiss-origin tech. - The gap? Domestic late-stage capital

Swiss VCs dominate early-stage but retreat later, creating risk of value capture shifting abroad. - Benchmarking for other nations

The Deep Tech Nation model—science-driven, exportable, university-rooted—is something mid-sized economies can replicate.

Takeaways

- Switzerland isn’t just catching up—it’s building a new standard for scientific commercialization.

- AI is rising fast, but biotech remains king—for now.

- The reliance on foreign late-stage capital is a double-edged sword.

- If Switzerland hits its 2033 targets (CHF 50B mobilized, 100K jobs), it may become Europe’s deep-tech anchor.

Sources

- Swiss Deep Tech Report 2025

- FintechNews.ch – Swiss Startup Funding 2024

- Startupticker – Innosuisse Swiss Accelerator

- ETH Zurich Spin-Off Report

- EPFL Startup Summary 2024

- Swiss Biotech Report 2025

- ANYbotics funding article – EU Startups