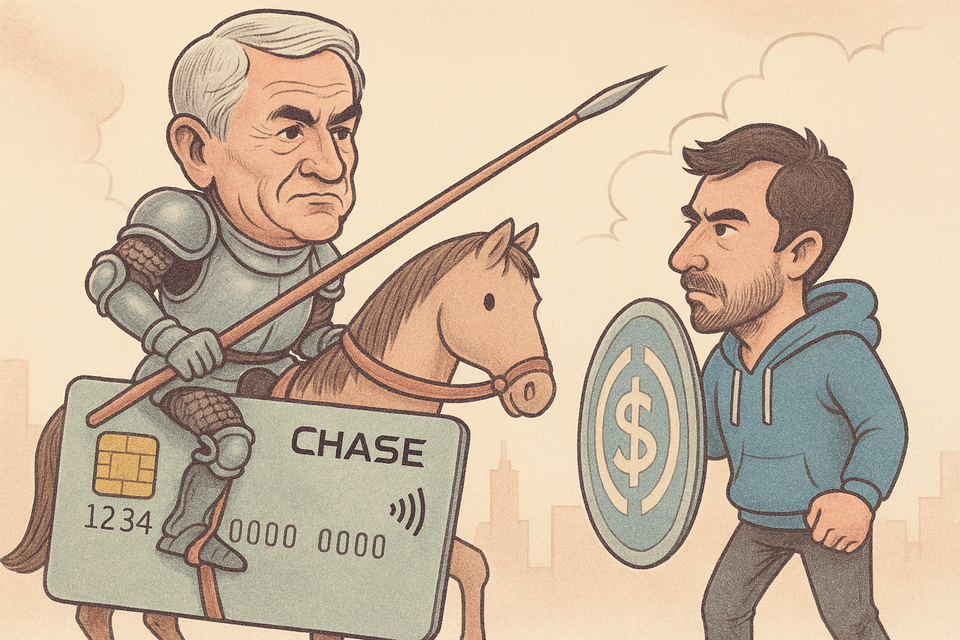

So Now JPMorgan Loves Crypto?

Or: How Jamie Dimon Learned to Stop Worrying and Love the Blockchain

“Bitcoin is a fraud.” — Jamie Dimon, 2017

“You can now buy crypto with your Chase card and convert reward points into USDC.” — Jamie Dimon, 2025, probably

Let’s Talk About the Deal

JPMorgan Chase, America’s biggest bank and proud TradFi flag-bearer, is now dating Coinbase. Publicly. On-chain. With benefits.

As of July 30, 2025, JPMorgan customers (read: 80 million of them) can:

- Link bank accounts directly to Coinbase

- Fund crypto buys using Chase credit cards (rolling out Fall 2025)

- Convert Chase Ultimate Rewards into USDC (at $1 per 100 points, debuting 2026)

No Plaid. No Yodlee. Just a JPMorgan-built API straight into Coinbase’s Base Layer 2 blockchain. Yes, Base. The one that Coinbase made.

So we’ve gone from “Bitcoin is rat poison” to “Would you like to redeem your points for stablecoins?”

The Moat Is Now the Pipes

TradFi isn’t building the moat anymore. It’s paving the road and charging tolls. JPMorgan’s custom API replaces data aggregators—meaning, sorry Plaid, no fee for you today.

Instead of trusting third parties to handle customer data, JPM just plugged itself into the crypto stack. KYC, AML, fraud screening—all native, all bank-grade.

And Coinbase? They're no longer just “that app you used to buy Ethereum during the Super Bowl commercial.” They’re infrastructure now. Custody, rewards, blockchain rails. TradFi’s backend is quietly turning Coinbase-colored.

Okay But Why Is This Smart?

For JPMorgan:

- New fee streams! You swipe, they skim.

- Younger customers think you “get it” now.

- Your rewards program is now Web3-native. You are cool again.

For Coinbase:

- Tens of millions of verified users walk through the door, KYC’d and ready.

- You don’t have to fight with Plaid anymore.

- You get called a “critical infrastructure partner,” which looks nice on investor decks.

Oh, and one more thing: Coinbase is in the S&P 500 now. So, when your Chase points buy USDC, and that runs through Coinbase, and that pumps COIN stock… well, that’s just efficient markets, baby.

Regulatory Tap Dance

This entire arrangement is extremely compliant, according to JPMorgan.

Their API embeds KYC and AML from the start. Coinbase, for its part, can self-certify listings as a designated contract market (DCM). But…

- Is buying crypto on your credit card a cash advance?

- Is converting points into USDC a taxable event?

- Is this entire setup going to make Gary Gensler’s eye twitch?

Probably yes to all three. But it’s 2025 and the ETF crowd is winning, so TradFi might get away with this one.

So Who Loses?

Fintechs. Mostly.

If your business depends on Plaid, this deal just told you: “Hey, the bank doesn’t need you anymore.”

If you’re Gemini, you probably just called this anti-competitive. If you’re a startup trying to make open banking a thing, JPM just built the wall and put their logo on every brick.

Even some analysts are whispering that this move makes stablecoins more centralized, not less. The USDC-Coinbase-Chase loop is tight. It’s efficient. But it’s not exactly what Satoshi dreamed of.

The Chart JPMorgan Probably Doesn’t Want You To See

| Upside | Downside |

|---|---|

| Swipe fees | Swipe fees... treated as cash advance? |

| Brand clout | Regulatory creep |

| API control | Aggregator lawsuits incoming |

| Cool-factor with Gen Z | Execution risk, hacks, UX failures |

| Crypto rails = TradFi profits | Fintechs might sue, users might churn |

The Vibe Check

So yeah. JPMorgan is crypto now. Or, more precisely, JPMorgan is Web2.5—they’ve sprinkled enough blockchain on top of a rewards system to make it feel like the future, but safe enough to keep grandma’s 401(k) unbothered.

Coinbase gets legitimacy, volume, and a better earnings call narrative. JPMorgan gets fees, control, and optionality. Customers get... stablecoins? Credit card debt? An app update?

Either way, this is big.

Sources

- JPMorgan and Coinbase launch direct integration

- Plaid sidelined as JPM builds own API

- $1 per 100 points conversion to USDC

- Your Chase card is now a crypto key

- AInvest report on infrastructure shift

- Bernstein: This removes the banking bottleneck

- Coinbase in the S&P 500

- Gemini and Winklevoss not happy

- CFTC allows self-certification of derivatives

- SEC crypto ETF rulemaking updates

- JPMorgan’s internal USDC valuation: $60B