How GLP-1 Drugs Are Reshaping U.S. Health, Consumer Behavior, and Business in 2025

Summary

GLP-1 medications like Ozempic and Mounjaro have moved beyond diabetes to redefine how Americans eat, shop, and spend.

With over 12 million users and rapid prescription growth, the ripple effects are visible across healthcare, retail, and even fashion.

This data-driven deep dive explores why the GLP-1 boom matters—and how it’s changing business strategy in real time.

From Medicaid spending to shrinking jean sizes, here’s what you need to know.

Introduction

GLP-1 receptor agonists—medications originally developed to treat type 2 diabetes—have become the most talked-about drugs in America.

In just five years, adult usage has increased nearly fivefold [2], with over 4% of U.S. adults now using them [2], primarily for weight loss.

These drugs, including Ozempic, Wegovy, and Mounjaro, are not only altering individual health outcomes but also causing widespread disruption across sectors such as food retail, fashion, fitness, and insurance.

In this article, we break down the numbers, trends, and business implications of the GLP-1 phenomenon, drawing from over 30 verified sources.

Trend Breakdown

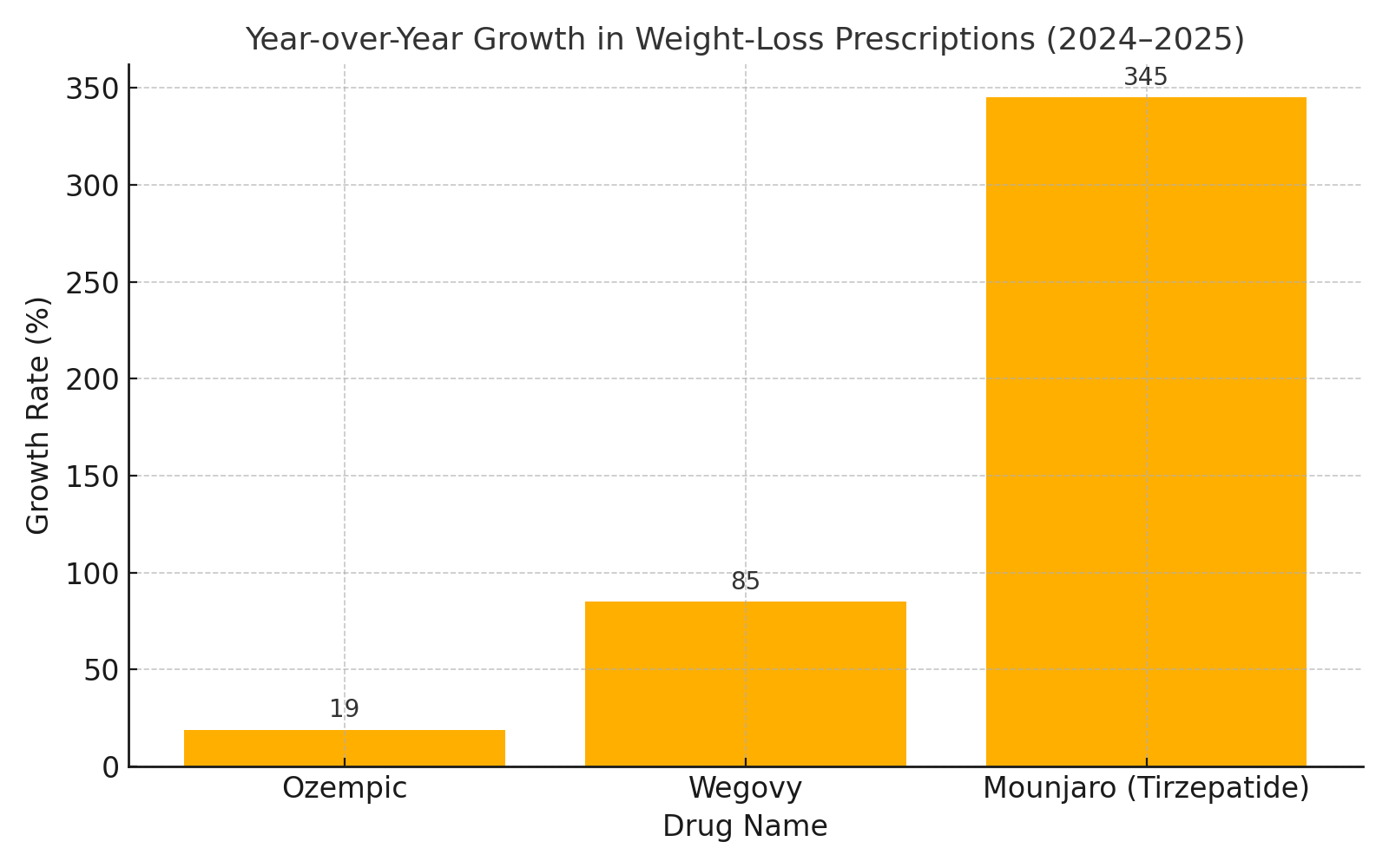

1. Adoption and Prescription Trends

- Ozempic still leads in volume [2], but Tirzepatide (Zepbound/Mounjaro) is outpacing in weight-loss growth [4].

- Among diabetics, 43% have used a GLP-1; among those told they're obese, 22% have tried it [2].

2. Obesity Impact and Clinical Data

- National adult obesity rate: 40.3% (2021–2023) [26]

- Severe obesity increased from 7.7% → 9.7% since 2013 [26]

- Most effective drug (Tirzepatide): Up to 18% body weight loss [11]

- Discontinuation rate (non-diabetics): 64.8% within one year [10]

- Reinitiation rate: 36.3% of non-diabetics restart within a year [10]

3. Financial and Insurance Landscape

- List prices exceeding $12,000/year [23]

- Hardship reported by 54% of users—even with insurance [9]

- Medicaid GLP-1 spend reached $4.1B in 2022 [23]

- Employer PMPM cost rose from $1.43 (2019) to $24.59 (2024) [3]

- Medicare offers no coverage for weight loss medications [16]

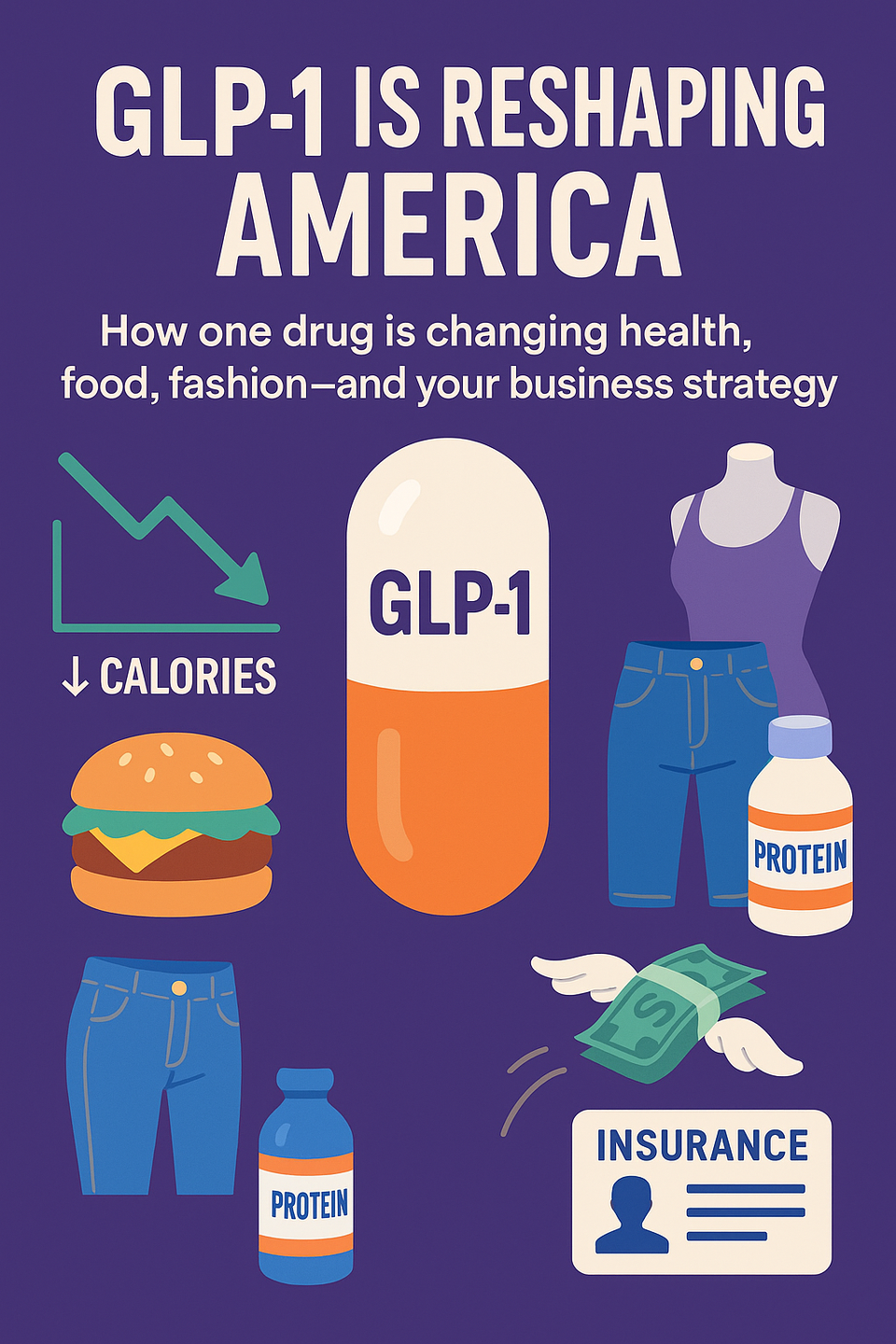

The GLP-1 boom is reshaping the economics of U.S. healthcare.

With list prices exceeding $12,000 per year, the financial burden now extends well beyond patients—impacting employers, insurers, and public programs alike. These costs are forcing a broad reconfiguration of benefit structures and reimbursement models across the system.

GLP-1s are medically transformative—but economically disruptive.

Unless structural reforms are introduced, affordability will remain the weakest link in this fast-growing ecosystem.

4. Off-Label Use and Adherence Issues

- 25.3% of plastic surgeons prescribe GLP-1s; 29.9% report personal use [17]

- Only 27.2% of patients meet adherence standards [18]

- 11.1% of users switch brands within one year [18]

5. Consumer Behavior Shifts

- As GLP-1 drugs reshape bodies, they’re also reshaping wallets and habits.

Here’s what the latest behavioral data reveals:

| Category | Change Among GLP-1 Users |

|---|---|

| Grocery Spending | ↓ 5.5% overall ↑ 8.6% among high-income users [22] |

| Snack Purchases | ↓ 11% [22] |

| Fast Food / Quick Serve | ↓ 8.6% [22] |

| Daily Caloric Intake | ↓ 20–30% [14] |

Interpretation:

GLP-1 users are eating less—and differently. Grocery spending has dropped overall, but among high-income users, it has increased—pointing to a pivot toward healthier, more premium food items rather than simply cutting back.

Snack and fast-food consumption are notably down, reflecting appetite suppression and changes in impulse-driven behaviors. The drop in caloric intake—up to 30%—is especially significant, not just for weight loss, but for the entire food economy.

These patterns signal an emerging shift in demand across multiple sectors:

- Snack and QSR brands may see shrinking volumes.

- Premium health food brands could benefit from a high-income GLP-1 user base.

- Supermarkets may need to rethink assortments as size curves and caloric preferences evolve.

6. Retail and Apparel Industry Response

- Brands adjusting inventory to smaller sizes (1-2-2-1 → 2-2-1-1) [21]

- Lululemon reported shortages of smaller sizes [21]

- Rent the Runway: Highest rate of size-downsizing in 15 years [21]

- GLP-1 users increased spending on jeans (+23%) and sweatpants (+50%) [21]

7. Fitness and Supplement Market Expansion

- Fitness clubs: +$6.8B total addressable market [31]

- Protein supplements: +13% growth (meal replacements) [32]

- Ready-to-drink protein beverages: +10% in 2023 [32]

Observation: GLP-1 users are more likely to engage in fitness post-weight loss, opening cross-sell opportunities.

8. Healthcare System Impact

- Bariatric surgeries ↓ 41.8% (2019–2024) [2]

- Behavioral health usage ↓ from 47.2% → 12.4% among GLP-1 users [27]

- Over 80% of obese patients still receive no medical weight loss intervention [2]

Why It Matters

The rise of GLP-1s is not just a health story—it’s a business disruption.

These drugs are altering how Americans eat, spend, shop, and move.

Companies from Walmart to Nestlé are adapting product lines, while employers reassess benefit costs.

At the same time, issues around cost, access, and real-world adherence remain unresolved.

This dynamic creates opportunity for innovation: from GLP-1-specific nutrition programs to insurance tech that improves coverage access.

It also raises societal questions—who gets access, and what happens when demand outpaces infrastructure?

Takeaways

- GLP-1s are reshaping sectors far beyond healthcare—from groceries and gym memberships to fashion retail and employer insurance plans.

- Affordability and access remain the biggest chokepoints despite surging demand.

- Early-movers across industries—from fitness to food—are capitalizing on behavior shifts.

- By 2035, over 30 million Americans may use GLP-1s, creating an ecosystem worth over $100B [14][31].

Sources

[1] On the Increase in Use of GLP-1s – https://medicine.iu.edu/blogs/bioethics/on-the-increase-in-use-of-glp-1s

[2] Axios – Just how many Americans are taking GLP-1s now – https://www.axios.com/2025/05/27/american-glp1-use-weight-loss-increasing

[3] AssuredPartners – A 2025 Update on the GLP 1 Landscape – https://www.assuredpartners.com/news-insights/blogs/employee-benefits/2025/a-2025-update-on-the-glp-1-landscape

[4] Truveta – GLP-1 Prescription Trends – https://www.truveta.com/blog/research/glp-1-prescription-trends-march-2025/

[5] MedRxiv – GLP-1 RA Prescribing Trends – https://www.medrxiv.org/content/10.1101/2024.01.18.24301500v3

[6] Healthcare Brew – Eli Lilly, Novo Nordisk Earnings – https://www.healthcare-brew.com/stories/2025/05/08/eli-lilly-novo-nordisk-strong-earnings-glp-1

[7] Saturday Evening Post – Is Obesity Declining? – https://www.saturdayeveningpost.com/2024/10/doctors-note-is-obesity-declining-and-is-it-really-ozempic/

[8] Nature – GLP-1 Effectiveness and Risks – https://www.nature.com/articles/s41591-024-03412-w

[9] KFF Health Tracking Poll – https://www.kff.org/health-costs/poll-finding/kff-health-tracking-poll-may-2024-the-publics-use-and-views-of-glp-1-drugs/

[10] JAMA – Discontinuation and Reinitiation of GLP-1s – https://jamanetwork.com/journals/jamanetworkopen/fullarticle/2829779

[11] JAMA – Tirzepatide Weight Loss Study – https://jamanetwork.com/journals/jama/fullarticle/2830204

[12] PMC – GLP-1 Reinitiation Patterns – https://pmc.ncbi.nlm.nih.gov/articles/PMC11786232/

[13] McKinsey – Consumers: Spending More to Buy Less – https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/consumers-spending-more-to-buy-less

[14] Morgan Stanley – Economic Impacts of GLP-1s – https://blog.implan.com/glp-1-medications

[15] Fast Company – Nestlé GLP-1 Strategy – https://www.fastcompany.com/90977810/ozempic-walmart-nestle-stock-market-effect

[16] GoodRx – Insurance Coverage Trends – https://www.goodrx.com/healthcare-access/research/tracking-insurance-coverage-weight-loss-meds

[17] PubMed – Off-Label Use by Plastic Surgeons – https://pubmed.ncbi.nlm.nih.gov/38085071/

[18] Journal of Managed Care Pharmacy – GLP-1 Adherence Study – https://www.jmcp.org/doi/10.18553/jmcp.2024.23332

[19] BuildingH – Walmart CEO Commentary – https://www.buildingh.org/news/2024/11/21/big-food-and-big-insurance-face-down-the-glp-1-threat

[20] William Blair – Restaurants and Fitness Impact – https://www.williamblair.com/Insights/GLP1s-Restaurants-and-Fitness-Clubs

[21] Modern Retail – Apparel Inventory Shifts – https://www.modernretail.co/operations/how-the-rise-of-glp-1-drugs-is-upending-apparel-inventory-planning/

[22] SSRN – The No-Hunger Games Study – https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5073929

[23] NCSL – Medicaid and GLP-1 Cost Breakdown – https://www.ncsl.org/resources/details/growth-volume-price-the-skinny-on-glp-1-medications

[24] Lilly Investor Relations – Q1 2025 Earnings – https://investor.lilly.com/news-releases/news-release-details/lilly-reports-first-quarter-2025-financial-results-and

[25] Skadden – GLP-1 Compounding Policy – https://www.skadden.com/insights/publications/2024/12/compounding-and-glp1s-what-to-expect

[26] CBS News – CDC Obesity Rates – https://www.cbsnews.com/news/obesity-rate-us-adults-cdc-data-map/

[27] Fierce Healthcare – GLP-1 Prescription Growth – https://www.fiercehealthcare.com/payers/fair-health-heres-how-much-glp-1-prescriptions-obesity-overweight-have-grown-2019

[28] UW Madison – Economic and Social Cost of GLP-1s – https://equilibriumecon.wisc.edu/2025/01/09/a-heavy-price-the-economic-and-social-costs-of-glp-1-weight-loss-drugs/

[29] iTiger – Novo Nordisk Q1 Earnings Shortfall – https://www.itiger.com/news/2523450717

[30] Advisory Board – End of GLP-1 Shortage – https://www.advisory.com/daily-briefing/2025/05/27/glp-1-compounders

[31] Athletech News – Gym Industry Opportunity – https://athletechnews.com/glp-1s-opportunity-for-gym-industry/

[32] CNBC – Protein Sales and Supplements Surge – https://www.cnbc.com/2024/06/11/glp-1-weight-loss-boom-spurs-protein-sales-vitamin-shoppe-says.html