Coinbase Q2 2025: $1.4 Billion Profit… But Wall Street Said “Nah”

Summary

Coinbase just reported $1.43 billion in net income for Q2.

That’s a 4,000% increase from the $36 million they made a year ago.

And their stock?

Down 7% in after-hours trading.

Because in crypto, apparently, making money isn’t enough — it has to be the right kind of money.

The Numbers

Let’s start with the headline figures — they look amazing until you, you know, read the footnotes.

- Total revenue: $1.50 billion

(missed the $1.59B estimate by 5.7%) - GAAP net income: $1.43 billion ($5.14 EPS)

vs. $36 million ($0.14 EPS) in Q2 2024 - Adjusted net income: $33 million ($0.12 EPS)

→ Because apparently not counting the $1.5B paper gains is a thing - Adjusted EBITDA: $512 million

(missed internal guidance of $564–587M)

So yes, Coinbase made a billion dollars — mostly thanks to their crypto holdings magically going up in value on the balance sheet.

They didn’t sell the assets. They just… marked them up.

Revenue Breakdown

A closer look at how Coinbase actually made money — or didn’t:

- Transaction revenue: $764 million

(down 39% QoQ, missed estimates by $50M) - Subscription & services: $656 million

(also missed $708M forecast)

→ mostly from custody, staking, and blockchain rewards - Stablecoin interest (primarily from USDC): $332.5 million

→ up slightly QoQ, but below $363M expectations

Coinbase also reported a $307 million loss from security incidents — including an exploit related to a third-party vendor breach.

Strategic Context

Here’s what went sideways:

- Trading volume: $237 billion

→ up 5% YoY, but down 26% QoQ - Crypto market volatility: dropped 16%

→ Less chaos = fewer trades = less fee income - Expenses:

→ Up 10% QoQ due to security, legal, and ongoing infrastructure investments

Meanwhile, their custody arm (Coinbase Prime) is still a bright spot — especially with the SEC’s blessing of multiple Bitcoin ETFs in Q2. Institutions like BlackRock and Franklin Templeton keep parking assets on their platform.

But for retail users? Engagement is slipping.

Less trading, less volume, less excitement.

What Investors Should Know

Wall Street was clearly hoping for:

- More real profits (not just accounting-based gains)

- Better trading volume rebound after Q1’s BTC rally

- A smaller miss on subscription & stablecoin interest revenue

- Some kind of spark to justify the 132% YTD rally into earnings

Instead, Coinbase delivered a bunch of accounting magic, missed core targets, and then blamed market “stability” for lower fees. Which is fair — but not sexy.

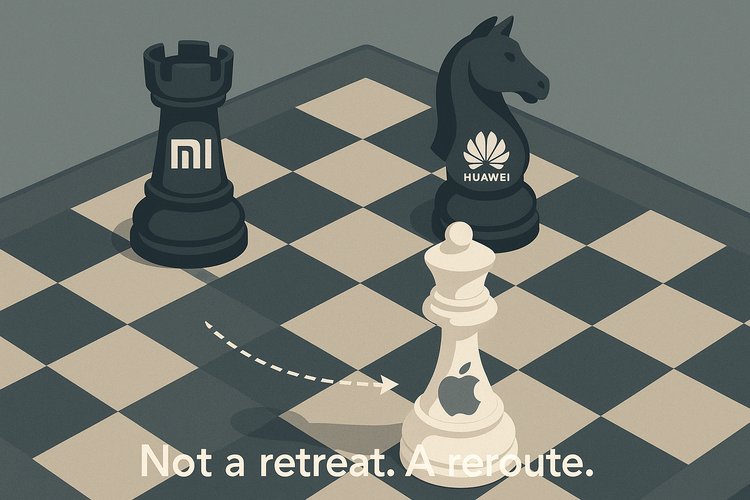

Takeaway

Coinbase had a huge quarter — on paper.

But the market doesn’t want paper gains. It wants boring, recurring, subscription-style revenue.

This quarter was a reminder:

You don’t get paid for hodling crypto. You get paid for helping others trade it.

And if they’re not trading, you’re just sitting on digital gold… hoping it goes up.

Coinbase is still the biggest name in U.S. crypto — and arguably the best positioned for a regulated future.

But Q2 proved one thing: the next bull run might have to do more than just boost the balance sheet.

It’ll have to move the needle where it counts — revenue and active users.