"Bigger, Smarter, More Global" – The New Face of U.S. Grocery Stores

Summary

From warehouse giants to ethnic markets, U.S. grocery stores are undergoing a transformation.

E-commerce, inflation, and shifting consumer values are driving structural changes.

Want to capture the next food opportunity? Start by understanding what’s reshaping the shelves.

Introduction

The U.S. grocery landscape—home to over 305,000 stores—is evolving fast.

While total industry revenue had dipped slightly (-0.1% CAGR over 5 years), 2025 marks a turning point with a projected $88.3 billion in sales (+1.1% YoY).

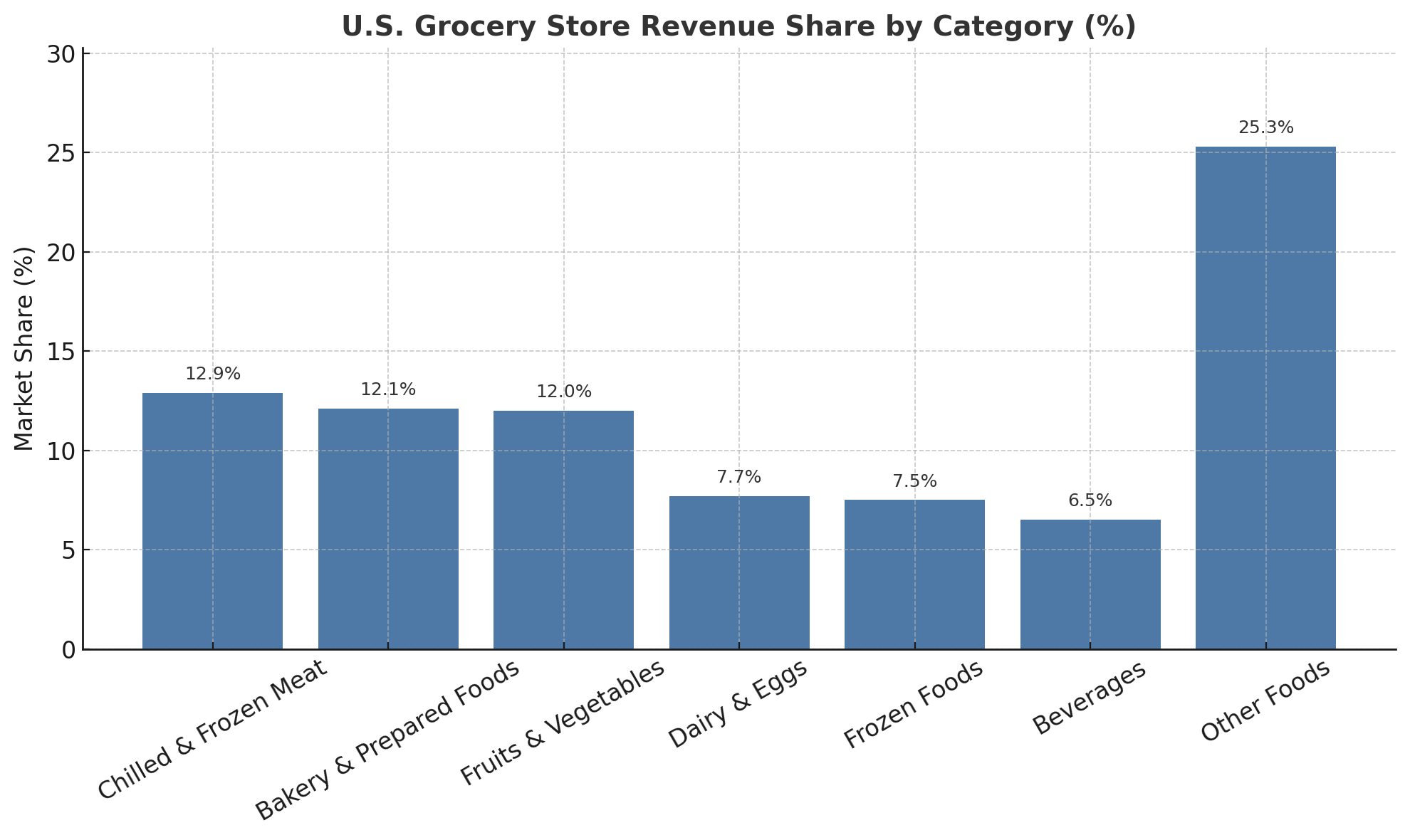

| Category | Revenue (US$ Billion) | Market Share (%) |

|---|---|---|

| Chilled & Frozen Meat | 113.9 | 12.9% |

| Bakery & Prepared Foods | 106.8 | 12.1% |

| Fruits & Vegetables | 106.0 | 12.0% |

| Dairy & Eggs | 68.0 | 7.7% |

| Frozen Foods | 66.2 | 7.5% |

| Beverages | 57.4 | 6.5% |

| Other Foods | 223.4 | 25.3% |

Note: “Other Foods” includes snacks, condiments, canned goods, and specialty items.

Source: IBISWorld (2024)

And beneath the surface? A wave of structural shifts driven by inflation, tech, and culture.

Let’s decode the three biggest shifts changing what Americans buy—and where they buy it.

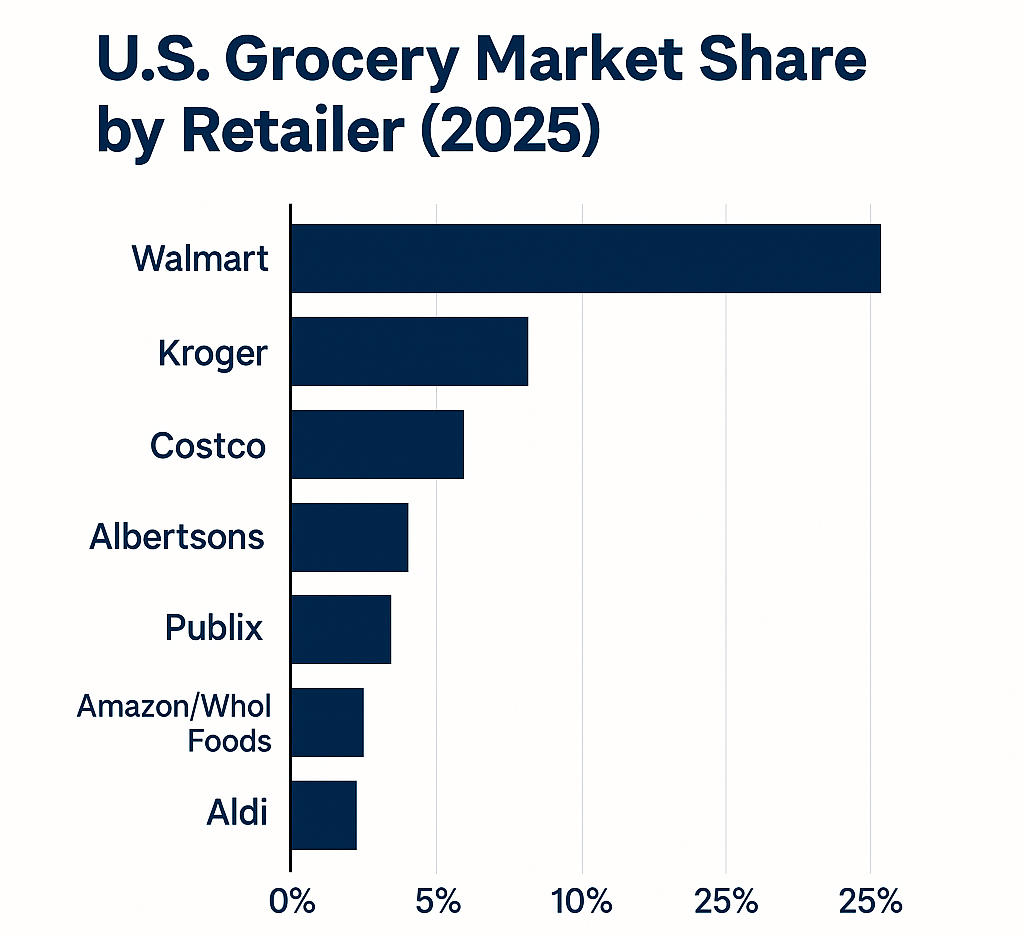

1.The Rise of Mega Chains

Big stores are getting even bigger—and fewer companies are owning more of them.

- Walmart, Kroger, Costco, Albertsons, and Amazon now control 60% of all U.S. grocery revenue【Solomon Partners】.

- Walmart alone holds an estimated 25–30% share, depending on the data source, with stores reaching 90% of Americans within a 10-mile radius.

- Kroger operates under 28 different store names nationwide—from Ralphs to City Market.

- A 2022 mega-merger between Kroger and Albertsons (worth $24.6B) was blocked in court for antitrust reasons—but smaller acquisitions continue.

📌 Why it matters:

As chain consolidation increases, local variety and price competition may shrink—making space for niche and value-driven players.

| Chain | Headquarters | Primary Operating Regions |

|---|---|---|

| Walmart | Bentonville, AR | Nationwide, strong in South & Midwest |

| Kroger | Cincinnati, OH | Midwest, South, Mountain regions |

| Albertsons | Boise, ID | West & Southwest |

| Ahold Delhaize USA | Quincy, MA | Northeast & Mid-Atlantic |

| Amazon | Seattle, WA | Urban centers nationwide |

| Grocery Outlet | Emeryville, CA | West Coast |

| H-E-B | San Antonio, TX | Texas statewide |

| Hy-Vee | West Des Moines, IA | Iowa, Illinois, Midwest |

| Northeast Grocery | Schenectady, NY | New York, New England |

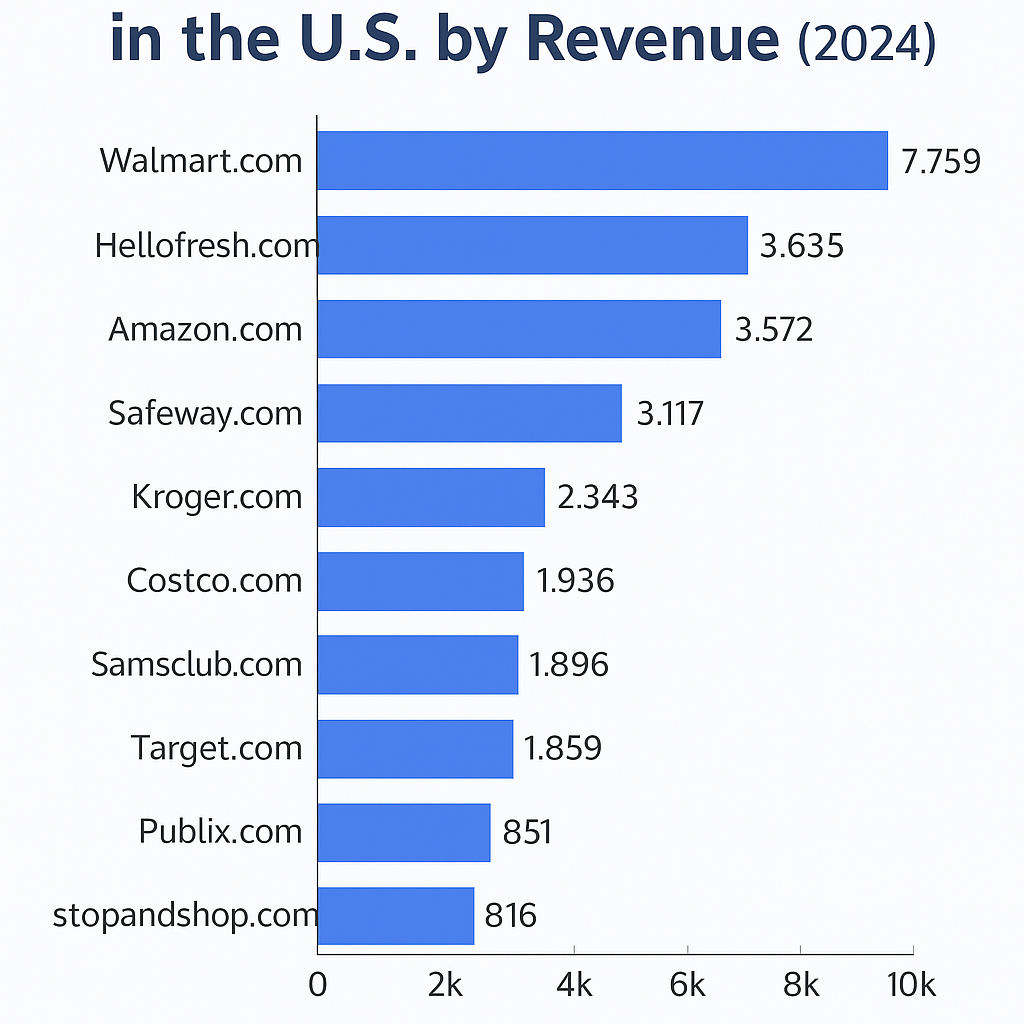

2.E-Grocery Goes Mainstream

Online grocery is no longer optional—it's the battlefield.

- In January 2025, U.S. online grocery sales hit $10B, up 16.5% YoY【Produce News】.

- By 2030, the market is projected to reach $715B, growing at 16.4% CAGR【Globe Newswire】.

- Over 138M Americans now shop groceries online—projected to reach 180M by 2029【Statista】.

🔍 Major players like Walmart, Amazon, and Kroger dominate—but smaller stores are turning to Instacart and dark stores (micro-warehouses hidden from customers) to compete.

AI is also being used for live inventory tracking, predictive supply chain management, and personalized product recommendations.

📌 Why it matters:

Grocers who fail to embrace tech risk being priced—and placed—out of the market.

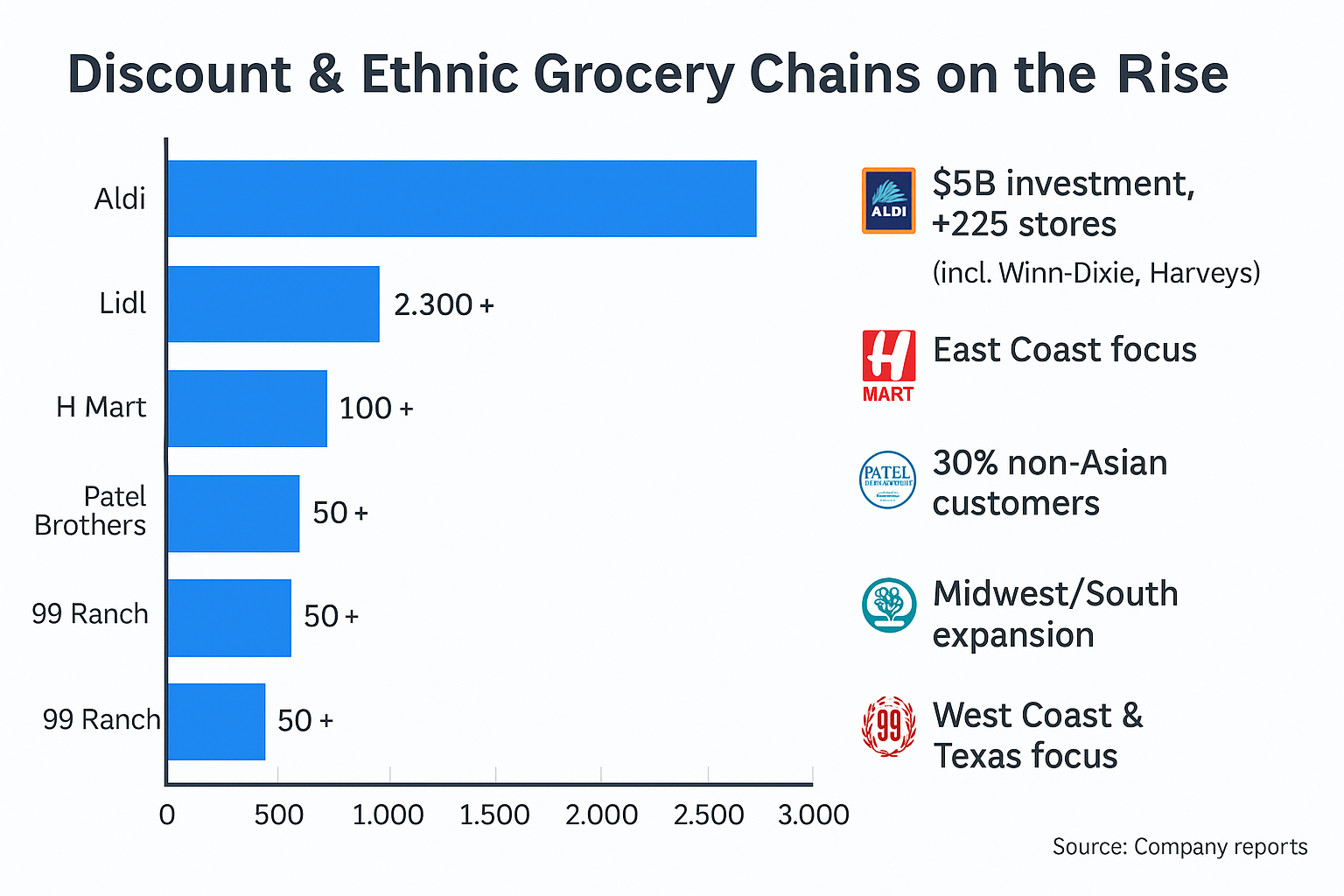

3.Discount Chains & Ethnic Markets Surge

As prices rise, so does the hunt for value—and authenticity.

- Aldi is investing $5B to open 225+ new stores, including acquired Winn-Dixie & Harveys locations.

- Lidl, the German newcomer, is strengthening East Coast presence with 180+ stores.

- H Mart, Patel Brothers, and 99 Ranch are expanding ethnic grocery offerings to a broader audience, with 30% of H Mart shoppers being non-Asian.

🌏 The U.S. ethnic food market reached $55.8B in 2024, with a projected 3.0% CAGR【IBISWorld】.

Consumers aren’t just shopping for deals—they’re exploring diverse flavors, especially in meal kits and TikTok-driven food trends.

📌 Why it matters:

Niche retailers are grabbing attention with cultural relevance, price competitiveness, and smarter online strategies—like Uber Eats partnerships.

Takeaways

- Consolidation ≠ Saturation: There’s still room for challenger brands—especially in cultural and functional foods.

- Online is essential: Hybrid models (delivery + local pickup) are now baseline expectations.

- Ethnic is mainstream: Korean, Indian, and Chinese grocers are redefining what “local” means.

For importers and food startups:

Understanding retail structure, price sensitivity, and FDA labeling updates (2026 deadline) will be crucial to landing shelf space.