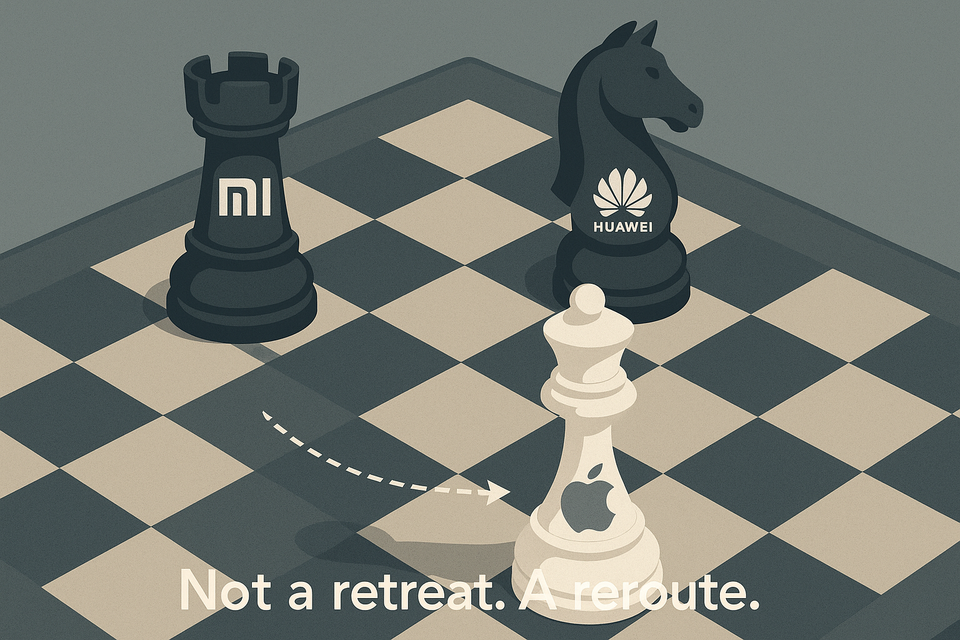

Apple Is Closing a Store in China. This Is Not Fine.

Summary

Apple is closing its store in Dalian, China. First time ever.

Officially, it’s “foot traffic.” Unofficially, it’s... everything else.

Nationalism, deflation, Huawei revenge, retail apocalypse—you name it.

Apple Doesn’t Do Store Closures. Unless It’s Dalian.

Here’s a fun stat: Apple has opened over 50 stores in China since 2008.

And it’s closed... zero. Until now.

Enter: Dalian Parkland Mall. Or rather, exit.

On August 9, Apple will shut it down, pack up the Genius Bar, and quietly ghost northeastern China.

No drama. No press release. Just a polite, passive-aggressive note:

“We’ll continue to serve customers online. Bye.”

Honestly? Feels like a breakup text.

The Mall Died First, Then Apple Did

Turns out the Dalian mall wasn’t exactly thriving.

Most of the luxury tenants left. Coach, Sandro, Boss, etc.

The place tried a rebrand as “Intime City.” Which is a name.

But no one came back.

And Apple? Well, they don’t need a store in a half-zombified mall with 25% vacancy and more pigeons than shoppers.

So, they left. Which makes sense. But also doesn’t.

Because when Apple gives up on a market—it usually means something bigger broke.

It’s Not Just the Mall. It’s the Economy.

Apple’s China revenue?

Down 6 quarters in a row. A perfect streak, if you’re into slow declines.

China’s consumer data looks like it caught a cold and forgot how to recover:

- CPI: negative for 4 months straight

- PPI: -3.3%

- New-home prices: down 6.8% YoY

- Youth unemployment: off the charts (or rather, off the data release)

Deflation isn’t a vibe. It’s a warning sign. And people don’t buy $1,000 iPhones in warning signs.

Huawei’s Comeback Tour Is Personal

So while Apple’s busy closing stores, Huawei’s out here doing a redemption arc.

- They launched a new Kirin chip.

- They pushed HarmonyOS like it’s a TikTok trend.

- They grabbed market share from 15% → 18% in a year.

Meanwhile, Apple fell from 4th to 5th. Not a huge deal, unless you’re Apple.

Then it’s mildly humiliating.

Oh, and guess who didn’t qualify for China’s national smartphone subsidies?

Apple. Too expensive.

Which is kind of the whole brand, but sure.

Politics. Always Politics.

Chinese consumers now view phones as symbols of loyalty.

Buying Apple = possibly unpatriotic.

Buying Huawei = you support national strength and grandma’s noodles.

Also: Chinese platforms boost local brands with SEO magic, trade-in deals, and algorithmic cuddles.

Apple? Not so much.

Why Should You Care?

Because this isn’t just Apple. It’s everyone.

Foreign brands in China are either:

- Pretending things are fine.

- Pivoting to “localised” versions of themselves.

- Quiet quitting the country.

Nike? Shrinking.

Tiffany? Downsizing.

Walmart? Closing hypermarkets, pushing Sam’s Club like it’s 2012 Costco.

So... What Now?

Honestly? No one knows.

China’s still a giant market, but no longer an easy one.

Deflation + nationalism + Huawei comeback = rough times for outsiders.

If you’re a global brand?

You better be cheap, local, or emotionally resonant.

Ideally, all three. But good luck with that.

Sources:

- Apple Q2 2025 Earnings Call – Apple Investor Relations

- Apple to Shut Down Its Only Store in Dalian, China – South China Morning Post (SCMP)

- China’s Consumer Prices Fall Again in June 2025 – CNBC

- Huawei Smartphone Market Share Rises in Q2 2025 – Counterpoint Research

- China’s Youth Unemployment Hits New Highs – National Bureau of Statistics (NBS) via Bloomberg

- China Retail Real Estate Trends – KOTRA Beijing (2025년 상반기)

- Walmart to Shut Down Hypermarkets in China, Focus on Sam’s Club – Retail Dive