America’s $18.4 Trillion Debt – And Why Nobody’s Screaming (Yet)

Summary

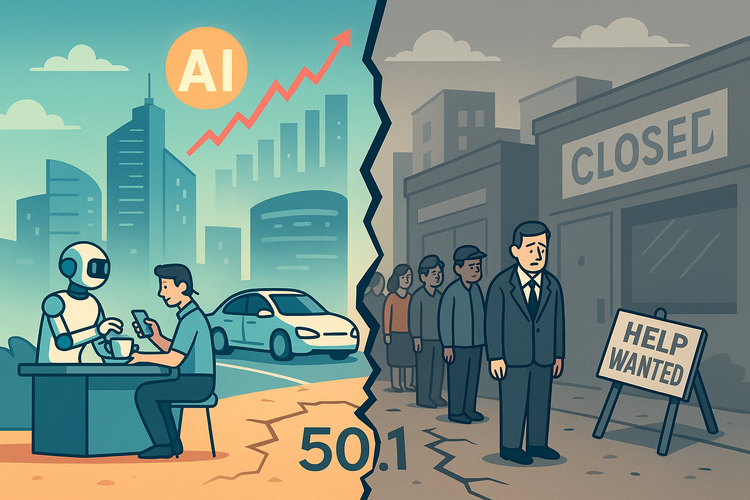

U.S. household debt hit a record $18.39 trillion in Q2 2025. Mortgages are still holding, but student loan delinquencies are exploding. Gen Z can’t repay, Boomers won’t stop borrowing, and somehow the Fed still says “we’re fine.” Let’s unpack that.

Introduction: The Debt Never Left

Debt is back. (Actually, it never left.)

According to the New York Fed, household debt in Q2 2025 rose by $185 billion to a total of $18.39 trillion. That’s a 1% quarterly increase — not huge in isolation, unless you remember this isn’t crypto. This is real, compounding, interest-bearing debt: mortgages, credit cards, auto loans, student loans.

And despite decades-high interest rates, Americans keep borrowing. Boomers, Gen X, Millennials, Gen Z — they’re all in. The difference is in who’s defaulting. And how quietly.