AI Therapy vs. Traditional Therapy: How 2025 Is Reshaping U.S. Mental Health

Summary

AI-powered mental health tools are no longer fringe solutions—they're scaling rapidly and reshaping how Americans seek therapy. With Gen Z embracing digital therapy and Medicare beginning to reimburse AI treatments in 2025, the traditional therapy model faces a fundamental shift. Here's how the industry is evolving—and what it means for businesses, insurers, and patients.

A. Introduction: Why 2025 Is a Tipping Point

The U.S. mental health crisis has collided with the rise of AI. In 2025, the global AI mental health market reached $1.8 billion and is projected to surpass $11.84 billion by 2034 [1]. While traditional therapy remains dominant for complex clinical cases, tools like Wysa, Woebot, and Headspace are now mainstream.

A major structural shift is underway:

- 93% of Gen Z and Millennials say improving their mental health is a top priority [2].

- Medicare now covers FDA-approved digital mental health devices [3].

- HR teams are integrating AI tools into employee benefits programs [4].

This transformation is not just clinical—it is economic, behavioral, and generational.

B. Trend Breakdown

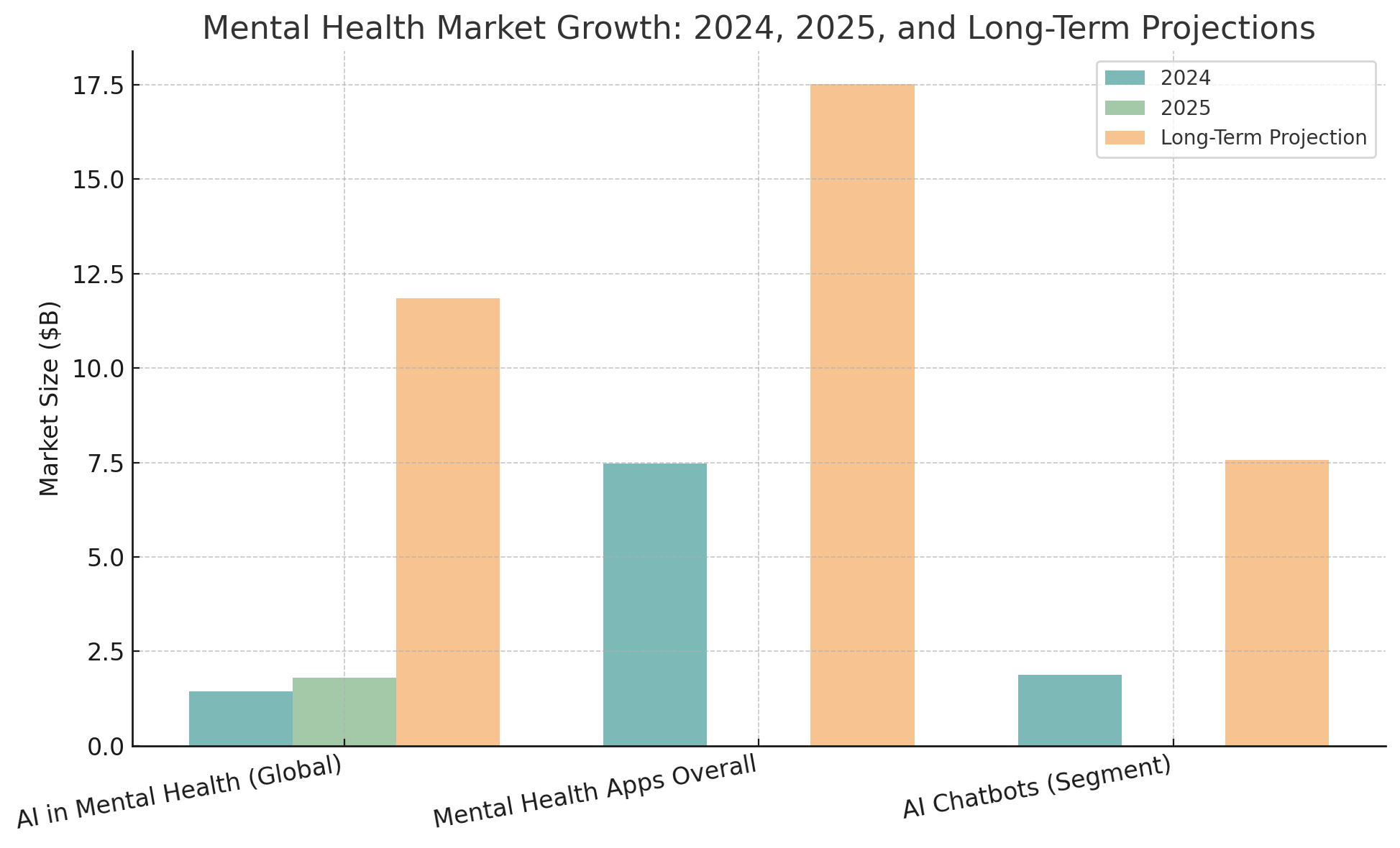

1. Market Size and Growth

| Segment | 2024 | 2025 | Long-Term Projection |

|---|---|---|---|

| AI in Mental Health (Global) | $1.45B | $1.8B | $11.84B by 2034 (CAGR 24.15%) [1] |

| Mental Health Apps Overall | $7.48B | – | $17.52B by 2030 (CAGR 14.6%) [5] |

| AI Chatbots (Segment) | $1.88B | – | $7.57B by 2033 (CAGR 16.53%) [6] |

- The AI in Mental Health market is projected to grow rapidly from $1.45B in 2024 to $11.84B by 2034, reflecting a compound annual growth rate (CAGR) of 24.15%.

- AI Chatbots, a subsegment, are also expected to rise from $1.88B to $7.57B by 2033 (CAGR 16.53%).

- In comparison, the overall mental health apps market will grow more moderately—from $7.48B to $17.52B by 2030 (CAGR 14.6%).

- The chart clearly shows that AI-driven segments are scaling faster than broader traditional digital health tools.

2. Funding Cycles and Startup Dynamics

- Behavioral health startup funding dropped 60% between Q4 2021 and Q1 2022 [6].

- App downloads declined over 30% since January 2021.

- Despite this, companies like Wysa raised over $23 million and continue acquiring enterprise clients [7].

- Mental health's share in digital health deals declined from 12% to 8%.

3. Gen Z and Therapy: New Norms

| Metric | Gen Z & Millennials |

|---|---|

| Currently in Therapy (2024) | 20% |

| Ever Attended Therapy | 53% |

| Plan to Attend Therapy (2024) | 39% |

| Openly Discuss Therapy | 83% |

| Want Lifelong Therapy | 26% |

The shift is cultural—therapy is no longer stigmatized. It’s expected [2].

4. Telehealth and Virtual Care Dominance

- 87% of all mental health sessions in May 2022 were virtual [13].

- Mental health is the only specialty where virtual visits continue to rise.

- Among adults aged 18–34, counseling usage rose from 12% in 2019 to 18.4% in 2022.

5. Insurance and Reimbursement

Medicare (from 2025 onward):

- Covers FDA-approved digital mental health devices when prescribed [3].

- Introduced new CPT billing codes for digital mental health services.

- Clinical social workers and licensed therapists are eligible for reimbursement.

Private Sector:

- Most mental health apps still face reimbursement challenges [12].

- When covered, insurers use device- or value-based payment pathways.

- Employer health plans increasingly offer AI therapy copays (~$15 per session) [4].

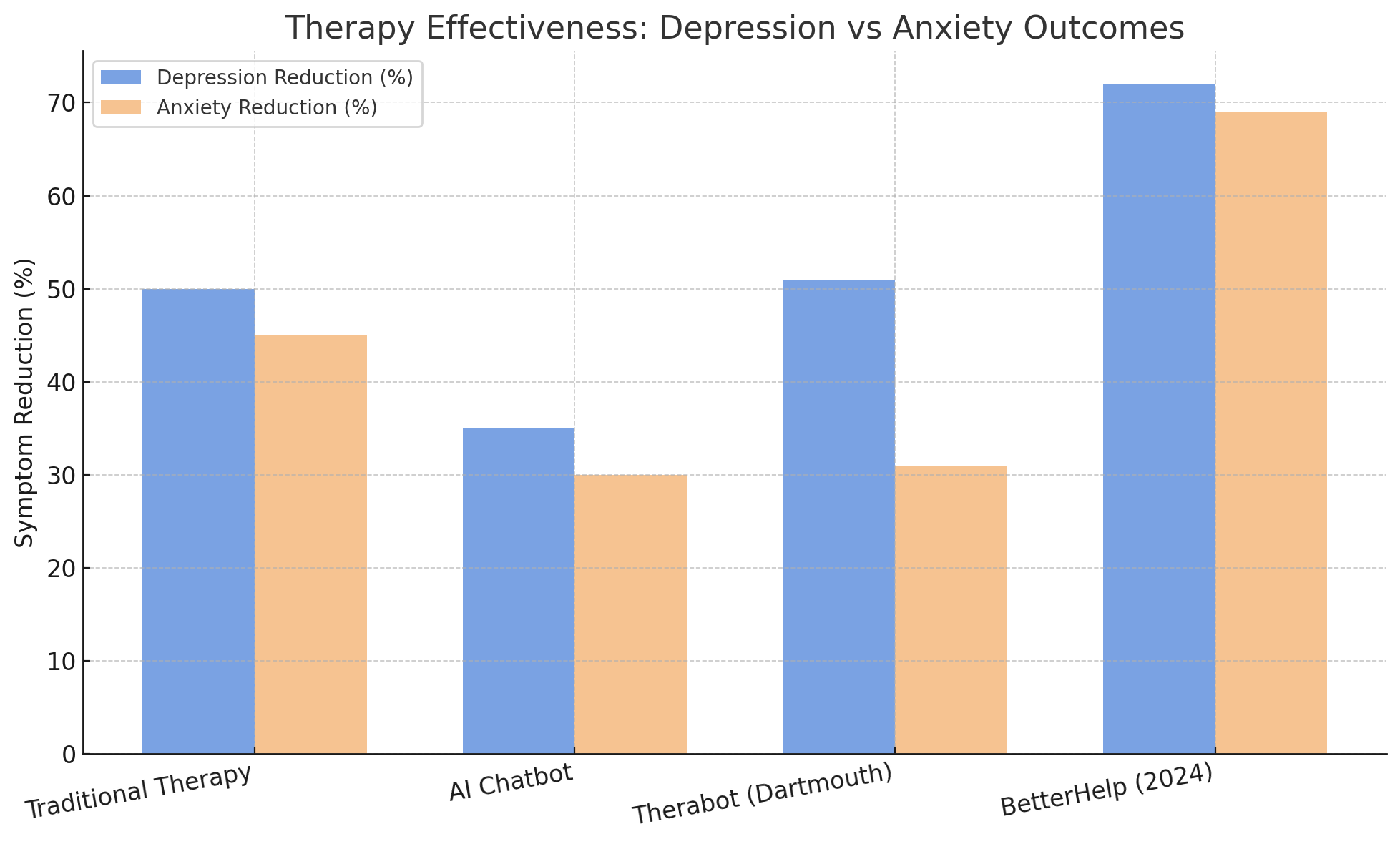

6. Cost, Outcomes, and Effectiveness

| Therapy Type | Avg. Cost | Depression Reduction | Anxiety Reduction | Notes |

|---|---|---|---|---|

| Traditional | $100–$300/session | ~50% | ~45% | Based on Ukraine-based study [6] |

| AI Chatbot | Low-cost subscription | ~35% | ~30% | Same study |

| Therabot (Dartmouth) | – | 51% | 31% | 8-week clinical trial [9] |

| BetterHelp (2024) | – | 72% symptom relief | 69% improvement | 900,000+ clients [8] |

- BetterHelp (2024) delivers the highest reported symptom improvement, with 72% reduction in depression and 69% in anxiety, based on data from over 900,000 users.

- Traditional therapy remains highly effective, reducing depression by ~50% and anxiety by ~45%, based on peer-reviewed clinical studies.

- AI chatbots show moderate effectiveness (~35% / ~30%), offering scalable and low-cost support—but with lower outcomes.

- Therabot (Dartmouth), an experimental AI tool, performed closely to traditional therapy for depression but lagged behind for anxiety.

AI tools are promising, especially for accessibility and cost—but human-led or hybrid models still lead in clinical effectiveness.

7. Accessibility and Scalability

- AI-powered chatbots provide 24/7 access without the need for appointments.

- They can scale to serve millions simultaneously.

- Particularly valuable in rural, underserved, or high-demand environments [6].

8. Regulatory Landscape and Privacy

- The FDA oversees software classified as digital mental health treatment devices [10].

- Draft guidance on clinical evidence standards for such tools is expected in 2025.

- HIPAA-compliant platforms, such as Google’s Gemini AI within Workspace, are gaining traction [12].

- AI tools used in care delivery are considered “high-risk” and must meet strict privacy and compliance standards.

9. AI Integration in the Workplace

- 46% of multinational companies plan to expand employee-facing AI tools for mental health [4].

- Apps like Calm, Headspace, Talkspace, and Ahead integrate mood tracking, guided activities, and social support.

- Talkspace launched a B2B platform, “Talkspace Engage,” to streamline access and promotion of mental health benefits [11].

10. Post-COVID Demand Persistence

| Population Segment | Anxiety (%) | Depression (%) | Notes |

|---|---|---|---|

| All U.S. Adults (2020) | 50% | 44% | vs. 8%/7% baseline in 2019 [13] |

| Adults 18–29 (2020) | 65% | 61% | Highest vulnerability group |

| Still Reporting Symptoms (2024) | ~30% | ~30% | Despite recovery, needs remain high |

Psychologists report longer waitlists and reduced availability of in-person appointments [13].

C. Why It Matters

- For Startups: A massive market is forming, but regulatory compliance and insurance access are major barriers.

- For Therapists: AI won’t replace humans but will reshape roles, especially in triage and CBT delivery.

- For Employers: AI therapy boosts employee engagement and reduces HR burnout.

- For Insurers: CMS coverage is opening new models—early movers will benefit from new enrollees.

- For Gen Z & Millennials: Blended care—AI tools plus human therapists—is fast becoming the standard.

D. Takeaways

- AI mental health tools are growing faster than traditional therapy can adapt.

- Outcomes for anxiety and depression are promising, especially for light-to-moderate cases.

- Regulation, insurance pathways, and trust are key friction points.

- Corporate wellness programs and federal policy are accelerating mainstream adoption.

E. Sources

- GlobalData – AI in Mental Health Market Forecast (2024–2034)

- Statista – Gen Z Mental Health Trends in the U.S. (2024)

- CMS.gov – 2025 Medicare Coverage for Digital Mental Health Devices

- McKinsey – Employer AI Benefits Strategy Report (2024)

- World Health Organization – Global Mental Health Apps Forecast

- CB Insights – AI Mental Health Chatbot Funding Landscape

- Crunchbase – Wysa Company Profile and Funding History

- BetterHelp – 2024 Outcomes and Clinical Efficacy Report

- Dartmouth College – Therabot Clinical Trial Summary

- FDA – Draft Guidance: Digital Health Treatment Devices (2025)

- Talkspace – Launch of Talkspace Engage B2B Platform

- HIPAA Journal – AI and Privacy in Mental Health Tools

- KFF – U.S. Mental Health Service Utilization and Spending