AI Is Now Your Shopping Assistant—and It's Not Asking for a Tip

Summary

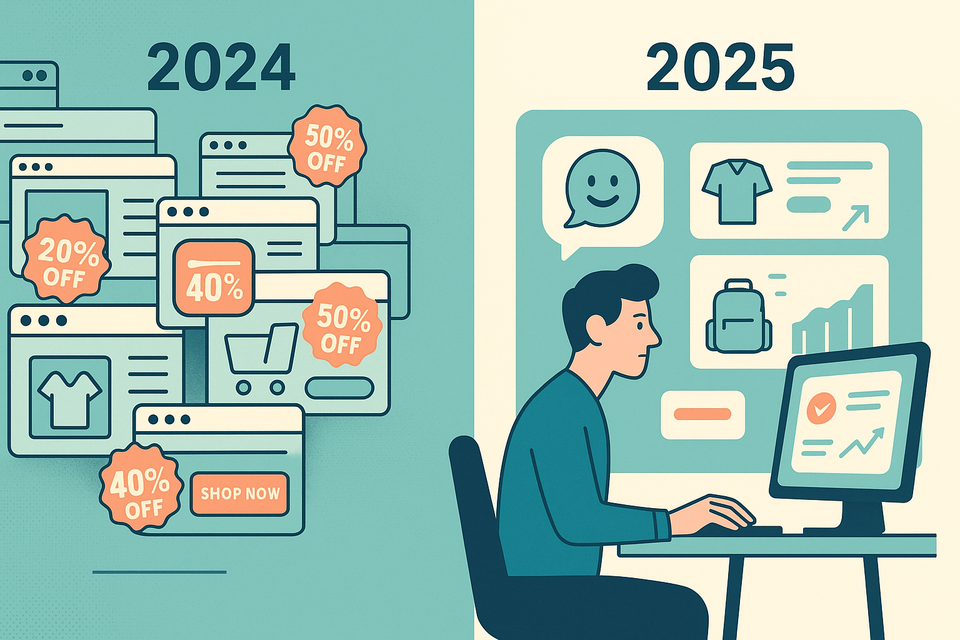

Generative AI is no longer a novelty in e-commerce—it's the new operating system. During Amazon Prime Day 2025, AI-driven traffic is expected to skyrocket by 3,200% year-over-year, helping fuel a projected $23.8 billion in U.S. online sales. With tools like ChatGPT Search, Perplexity Pro, and Amazon Rufus battling for shopping assistant dominance, the retail funnel is being rewritten. But not everyone is on board—and that's where the real tension lies.

Introduction: The End of Endless Scrolling

We used to call it comparison shopping. Back when it meant opening 17 tabs and whispering, “please let this coupon code work.” Today? You paste a product link into an AI chat, and it tells you where to get it cheaper, when it might drop further, and whether you're being ripped off by a fake discount.

Welcome to Prime Day 2025—where AI is the hunter, not the hunted.

Trend Breakdown

Key Data

| Metric | 2024 | 2025 (Forecast) | Growth |

|---|---|---|---|

| GenAI Shopping Traffic | Baseline | +3,200% | Explosive |

| Total U.S. Online Sales | $18.5B | $23.8B | +28.4% |

| Mobile Share of Sales | 50.1% | 52.5% | Rising |

| Conversion Rate (AI Users) | Lower | Narrowing gap | Improving |

Why Shoppers Are Using AI

- Product Research: 55%

- Recommendations: 47%

- Finding Deals: 43%

- Gift Ideas & Unique Finds: 35%

- List Building: 33%

Platforms at Play

- Amazon Rufus: Deep Amazon catalog integration, but limited to Amazon’s ecosystem. Expanding globally.

- ChatGPT Search: Personalized, ad-free, non-commissioned product discovery. Over 1B queries weekly.

- Perplexity Pro: Visual search, buy-in-chat, merchant integration. Commission-free.

Why It Matters

- Retailers are losing the front door: If AI tools become the starting point, retailers must adapt to be visible inside AI interfaces.

- Price opacity is dead: AI exposes pricing history, fake markdowns, and competitor pricing in real time.

- Consumers are algorithmically empowered: Brand storytelling now competes with raw utility.

- But there's still friction: 43% of consumers remain uneasy about AI analyzing personal data.

Takeaways

- AI-driven traffic is real—and growing exponentially.

- Retail UX must evolve for AI-first discovery: structured data, API feeds, and better metadata matter.

- Commission-free AI tools will shape purchase decisions more than affiliate-driven ones.

- Brand loyalty is fading—pricing intelligence now speaks louder.

- The next war isn’t for ad slots. It’s for prompt visibility inside AI systems.